Squid Game Season 3: A Global Phenomenon, Two Contrasting Audiences – A Comparative Look at India and Singapore

Squid Game Season 3 captured attention across Asia, but reactions in India and Singapore revealed stark contrasts. This study by Z.com Research, based on feedback from 1,299 Indian and 307 Singaporean respondents, highlights how one cultural event unfolded into two distinct viewing journeys - shaped by content accessibility, emotional engagement, and broader societal dynamics.

In India, audiences responded with strong emotional involvement and enthusiastic social sharing. In contrast, Singaporean viewers approached the show with a more selective and reflective mindset. These differences underscore the importance of tailoring global entertainment to fit local tastes in order to truly connect with diverse audiences.

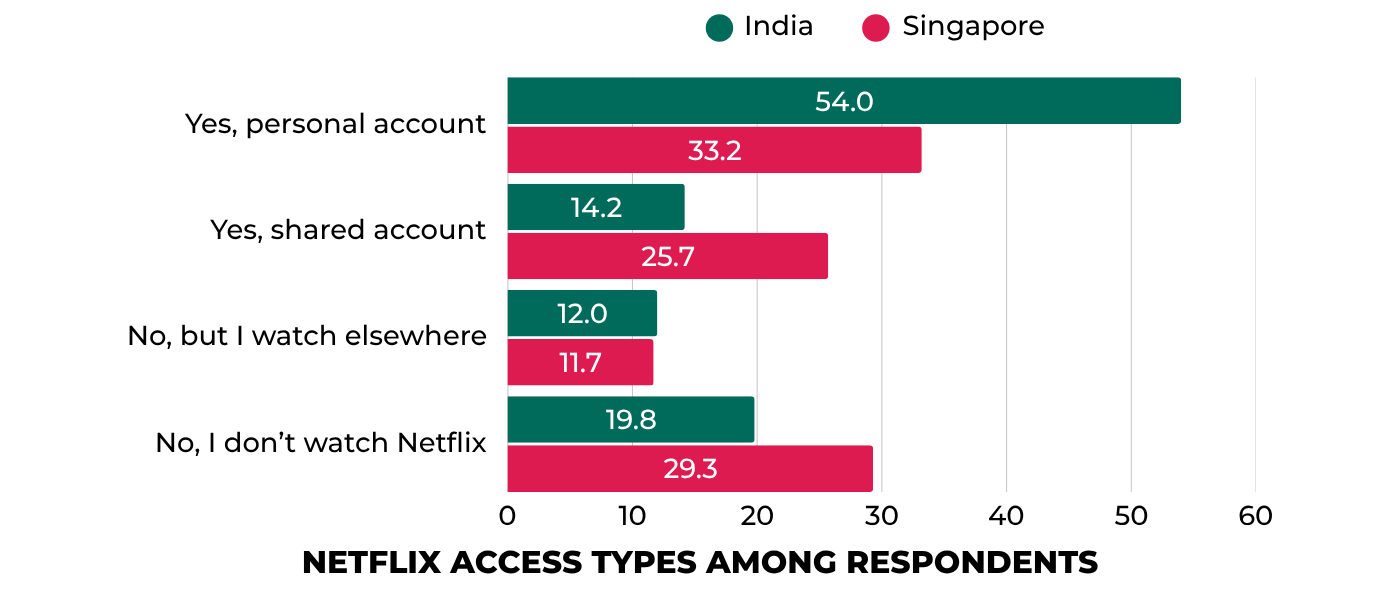

Netflix access impacts viewer engagement

India: Broad access drives deeper involvement

In India, 68.2% of respondents have access to Netflix, either through their own account (54%) or a shared one (14.2%). This widespread availability likely fuels higher consumption and awareness of international shows. Even among the 12% without a Netflix account, many still find ways to follow trending series via YouTube clips, Telegram, or viral social media memes. Only 19.8% reported not watching Netflix at all.

This high accessibility creates a strong foundation for international hits like Squid Game to thrive. Indian viewers tend to stay updated with what’s trending, which helps maintain interest across multiple seasons. The consistent viewership into Season 3 suggests that once Indian audiences are hooked, they tend to remain loyal.

Singapore: Lower access, more discerning consumption

In contrast to India, Netflix usage is significantly lower in Singapore. Only 33.2% of respondents have their own Netflix account, and while an additional 25.7% share access with others, nearly 29.3% report not using Netflix at all-a sizable portion that limits the natural spread of streaming trends within the country.

Still, Squid Game has achieved strong cultural visibility. About 25.4% of respondents are familiar with the show despite never having watched it, indicating its widespread recognition. However, unlike India-where broad awareness tends to convert into active viewership-Singaporean audiences seem more selective. Content must prove its worth, and even international hype isn’t enough to guarantee attention.

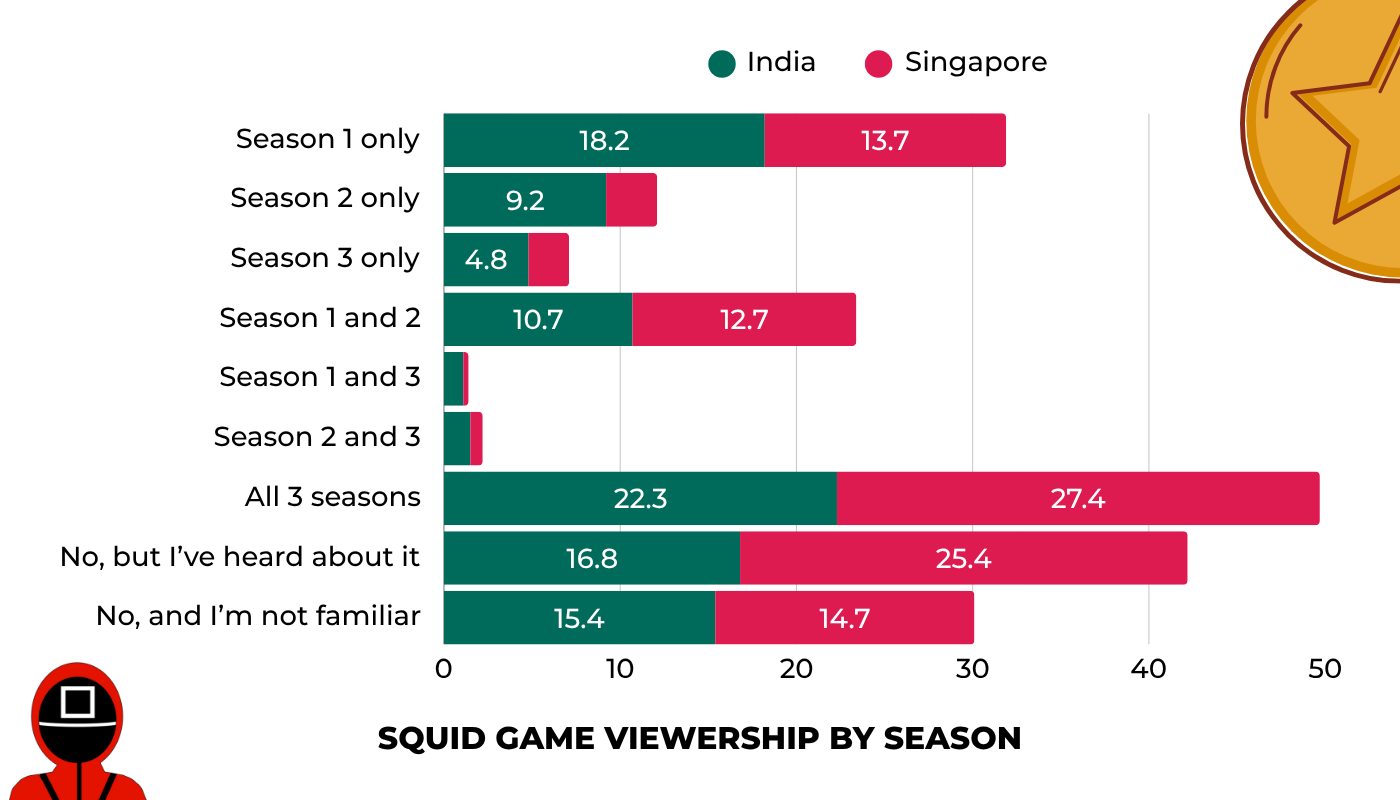

Interestingly, once Singaporean viewers commit to a show, they tend to stick with it. A notable 27.4% have watched all three seasons of Squid Game, slightly outpacing the 22.3% of Indian viewers. This indicates that while Singaporeans may be more cautious in what they choose to watch, their loyalty and engagement run deep once they’re invested.

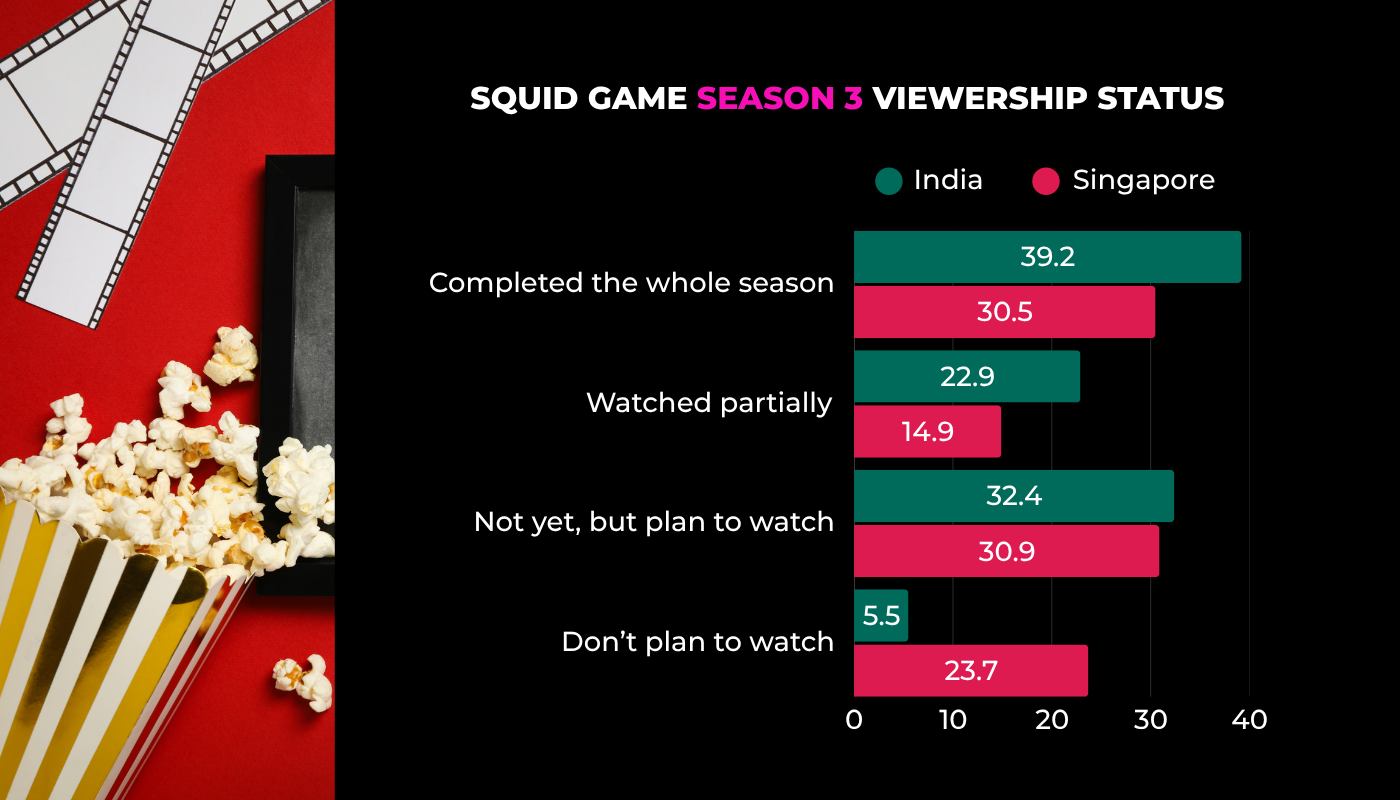

Squid Game 3: Widely embraced in India, more polarizing in Singapore

The June 2025 premiere of Squid Game Season 3 stirred strong reactions throughout Asia, but viewer sentiment diverged sharply between India and Singapore.

In India, enthusiasm was unmistakable-62.1% of respondents had already started the new season, and 39.2% had finished it entirely. Even among those who hadn’t watched yet, most indicated plans to do so, reflecting continued enthusiasm for the series.

Singapore, however, showed a more cautious response. Only 30.5% had completed the season, and nearly a quarter (23.7%) said they had no plans to watch it at all, signaling a more divided reception.

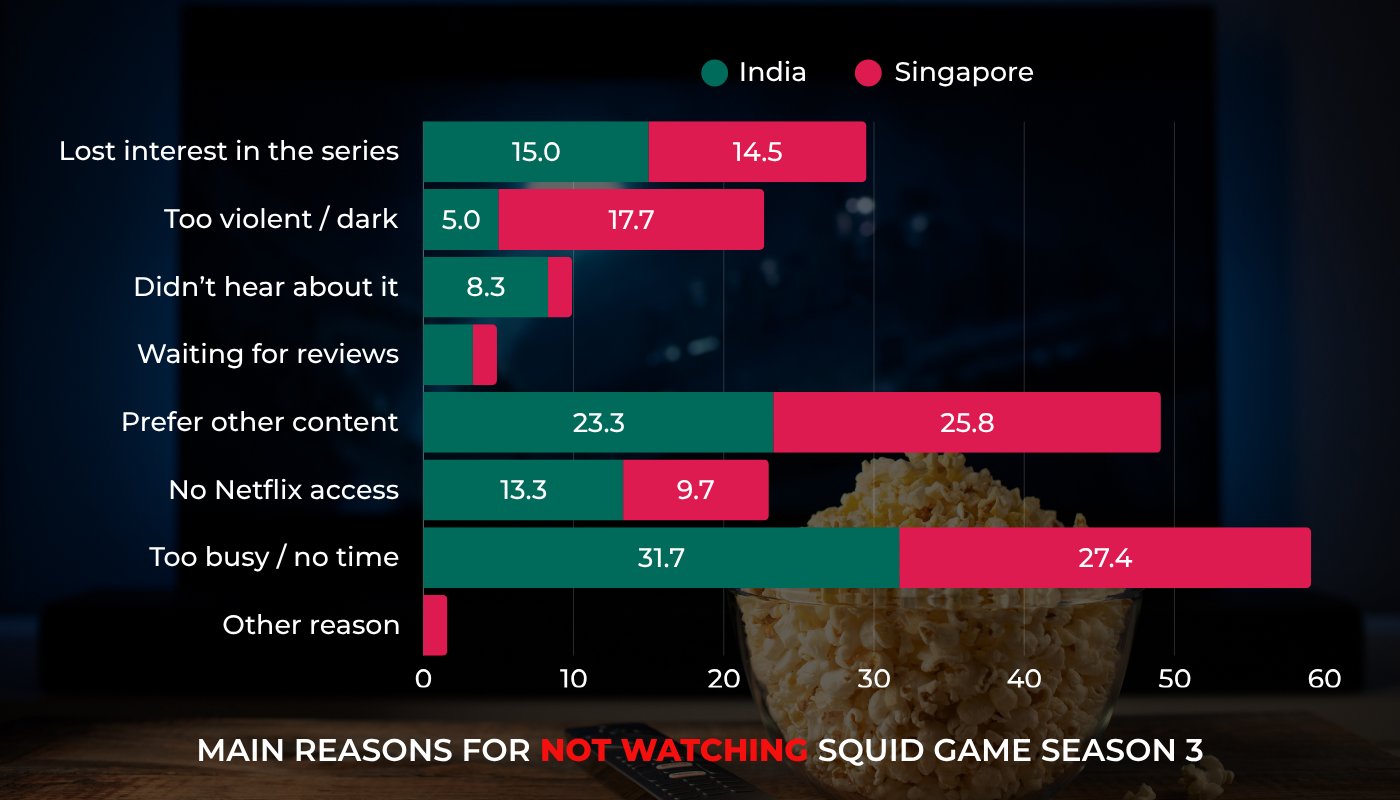

Why some viewers opted out of Squid Game Season 3

Time constraints and shifting interests lead the list

For viewers in both countries, the main reason for skipping Season 3 was a lack of time. Around one-third of non-viewers in India (31.7%) and Singapore (27.4%) said they were simply too busy.

Other common reasons included changing preferences-many now favor other shows (India: 23.3%, Singapore: 25.8%)-and a gradual decline in interest in the Squid Game franchise.

Singapore viewers more sensitive to dark themes

A notable difference emerged around content tone: 17.7% of Singaporean non-viewers found the show too violent or disturbing, compared to just 5% of Indian respondents. This reflects a broader trend in Singapore toward lighter, less intense programming, as seen in their top streaming choices.

The findings suggest that for Singaporean audiences, the tone and emotional weight of a show play a more critical role in shaping viewing decisions than just availability or time.

What motivates viewers to press play?

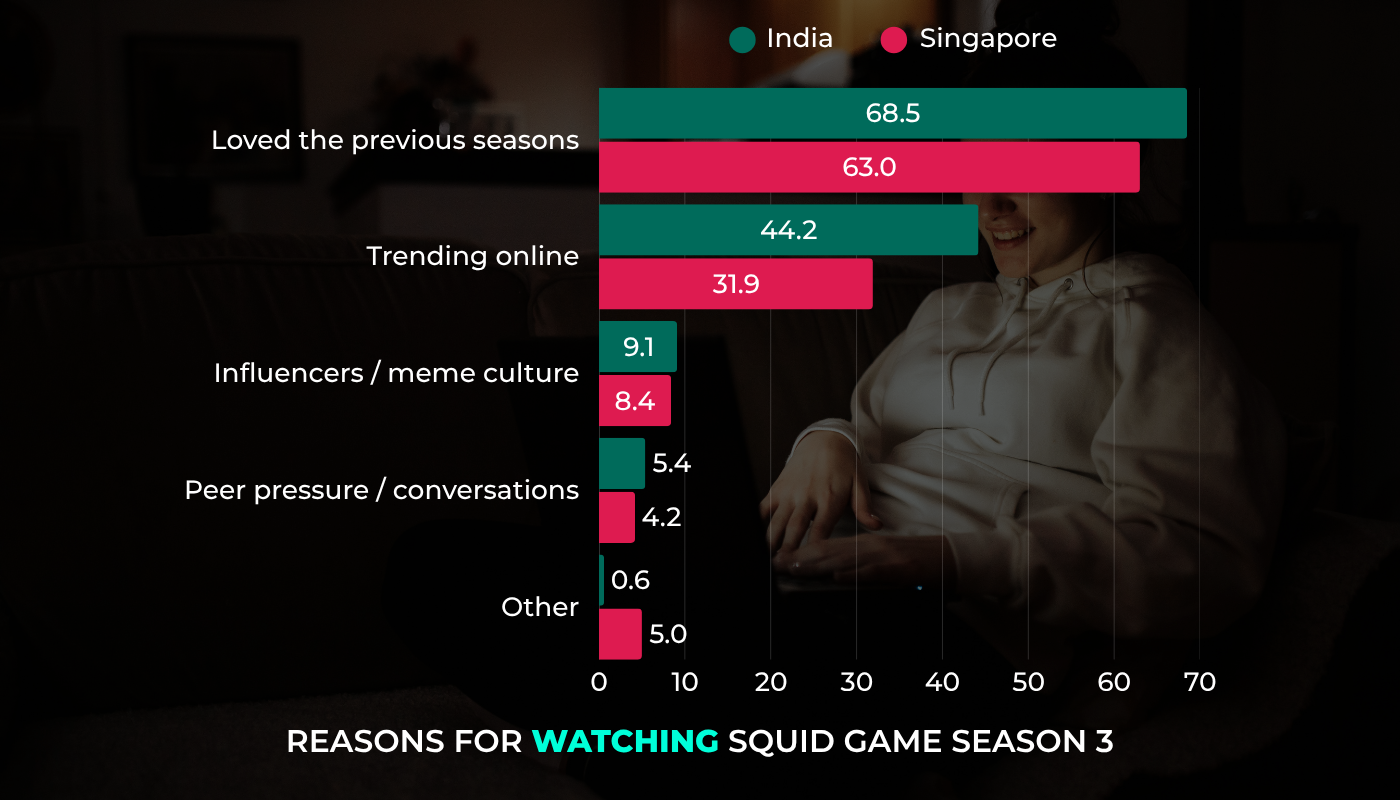

The legacy of past seasons drives continued interest

For those who decided to watch Season 3, the overwhelming reason was their appreciation for the previous seasons. In India, 68.5% cited this as their primary motivation, closely followed by 63% in Singapore. This highlights the power of strong storytelling and emotional connection in sustaining viewer loyalty-even in today’s crowded streaming space.

Hype plays a bigger role in India

Indian viewers were significantly more swayed by social media buzz and online discussions, with 44.2% saying the hype influenced their decision to watch. In contrast, only 31.9% of Singaporean viewers said the same. Meme culture and influencer commentary also played a role in both countries, though slightly more so in India (9.1%) than in Singapore (8.4%).

Singaporean audiences, on the other hand, appear less reactive to viral trends-perhaps due to an older demographic or more intentional viewing habits. Rather than chasing what's trending, they seem to prioritize shows that match their personal preferences and established routines.

Season 3 divided opinions between Indian and Singaporean viewers

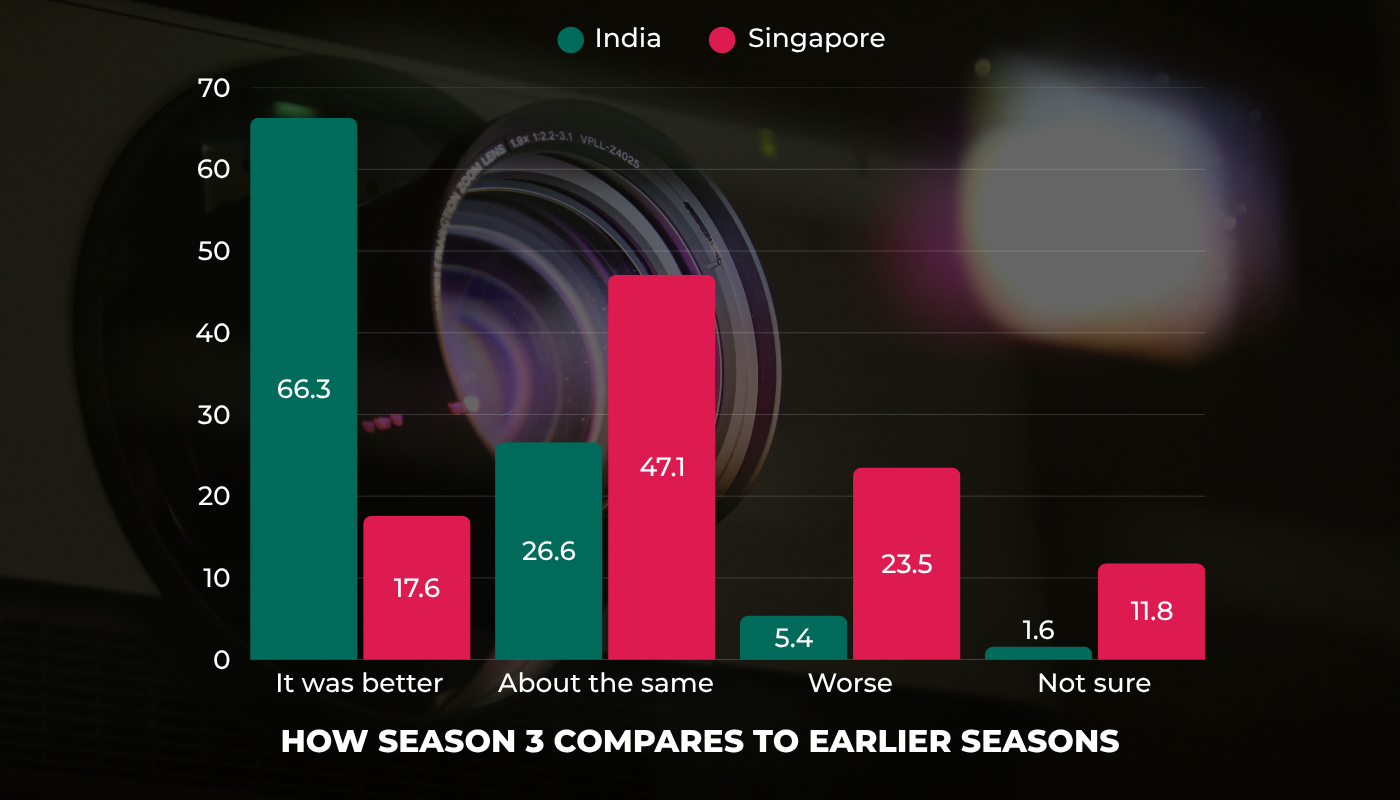

Indian audiences saw Season 3 as a step up

A large majority of Indian respondents (66.3%) believed that Season 3 surpassed its predecessors. This strong endorsement reflects how the series maintained its appeal through inventive game concepts, deeper character development, and emotionally charged scenes-such as childbirth or moral conflicts. Very few viewers felt that “nothing stood out,” indicating strong narrative engagement and emotional connection.

The show's trademark suspense, plot twists, and fresh character journeys resonated particularly well with Indian viewers-especially those who enjoy binge-watching and immersing themselves in dramatic arcs. These reactions are consistent with earlier findings showing high interest and strong responsiveness to online buzz.

Singaporeans were more cautious and critical

In contrast, only 17.6% of viewers in Singapore considered Season 3 an improvement, while nearly 1 in 4 (23.5%) thought it was worse. Almost half (47.1%) rated it “about the same” as earlier seasons, indicating a more neutral or restrained reception. This cooler response may stem from genre fatigue or unmet expectations.

Singaporean viewers appeared less engaged with the action and twists that defined Season 3. Their critiques may be linked to slower pacing, weaker connections with new characters, or a tone that didn’t quite align with their preferred viewing styles-suggesting a disconnect between the show’s direction and local audience tastes.

What stood out the most to viewers?

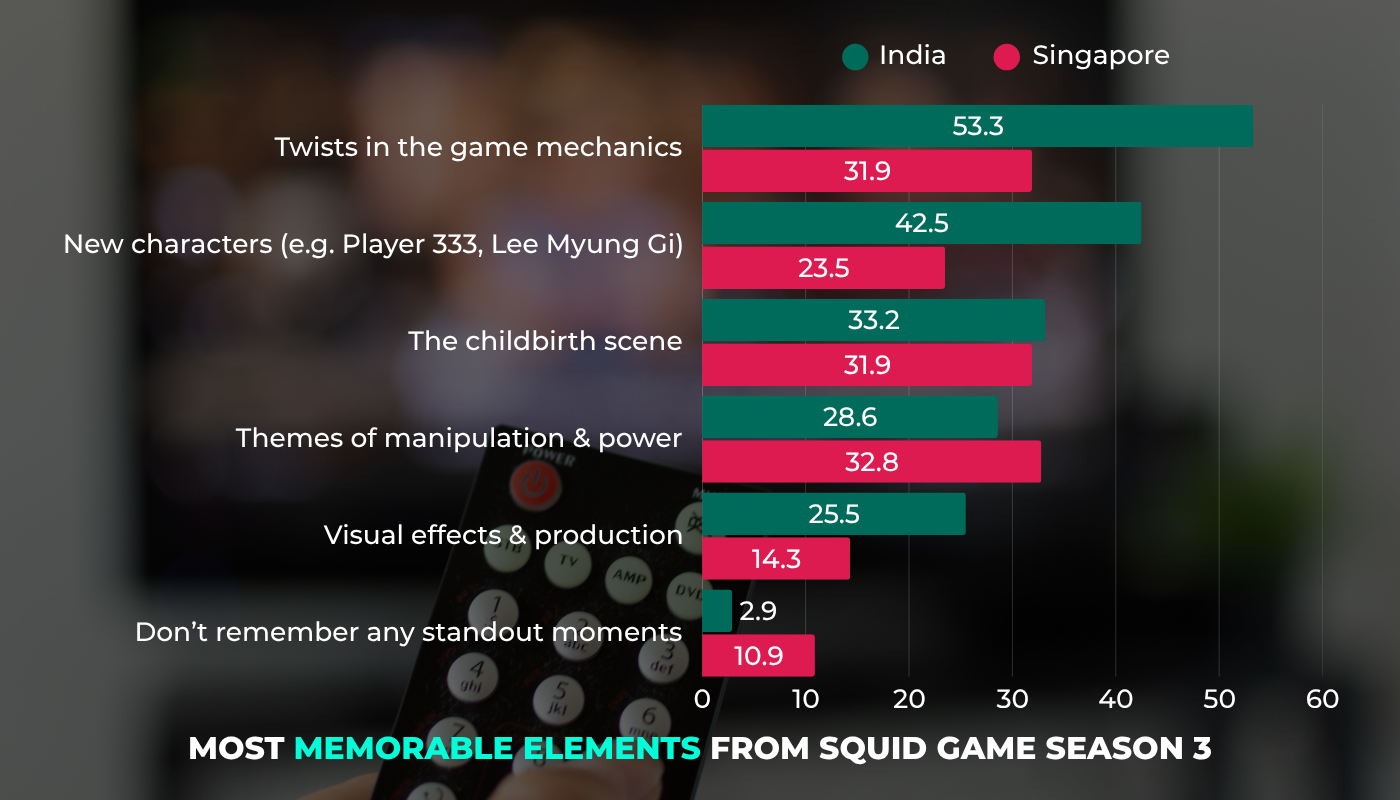

Indian audiences were most impressed by game twists and new characters

When asked what left the strongest impression, Indian viewers pointed first to the surprising changes in game mechanics (53.3%), followed closely by the introduction of new characters like Player 333 and Lee Myung Gi (42.5%). These responses suggest that Season 3 effectively built on the show’s core strengths-strategic tension, fresh faces, and intense competition.

The childbirth scene also resonated strongly, with 33.2% mentioning it as a standout moment. This emotional response may reflect a deeper cultural connection to themes such as sacrifice, parenthood, and resilience, which added another layer of meaning to the season for Indian viewers.

Singaporean viewers prioritized deeper themes over dramatic spectacle

While elements like game twists and the childbirth scene still resonated with Singaporean audiences (31.9%), a slightly higher percentage (32.8%) were most impacted by the show’s exploration of power dynamics and manipulation. This suggests that Singaporean viewers may lean more toward psychological depth and symbolic storytelling rather than action-driven narratives.

Interestingly, 10.9% of Singapore respondents said that “nothing stood out” to them-a notably higher figure than India’s 2.9%. This further underscores the more reserved and underwhelmed response observed throughout, potentially stemming from issues like slow pacing, weaker emotional connection, or content fatigue.

India sees deeper moral resonance, Singapore takes a lighter view

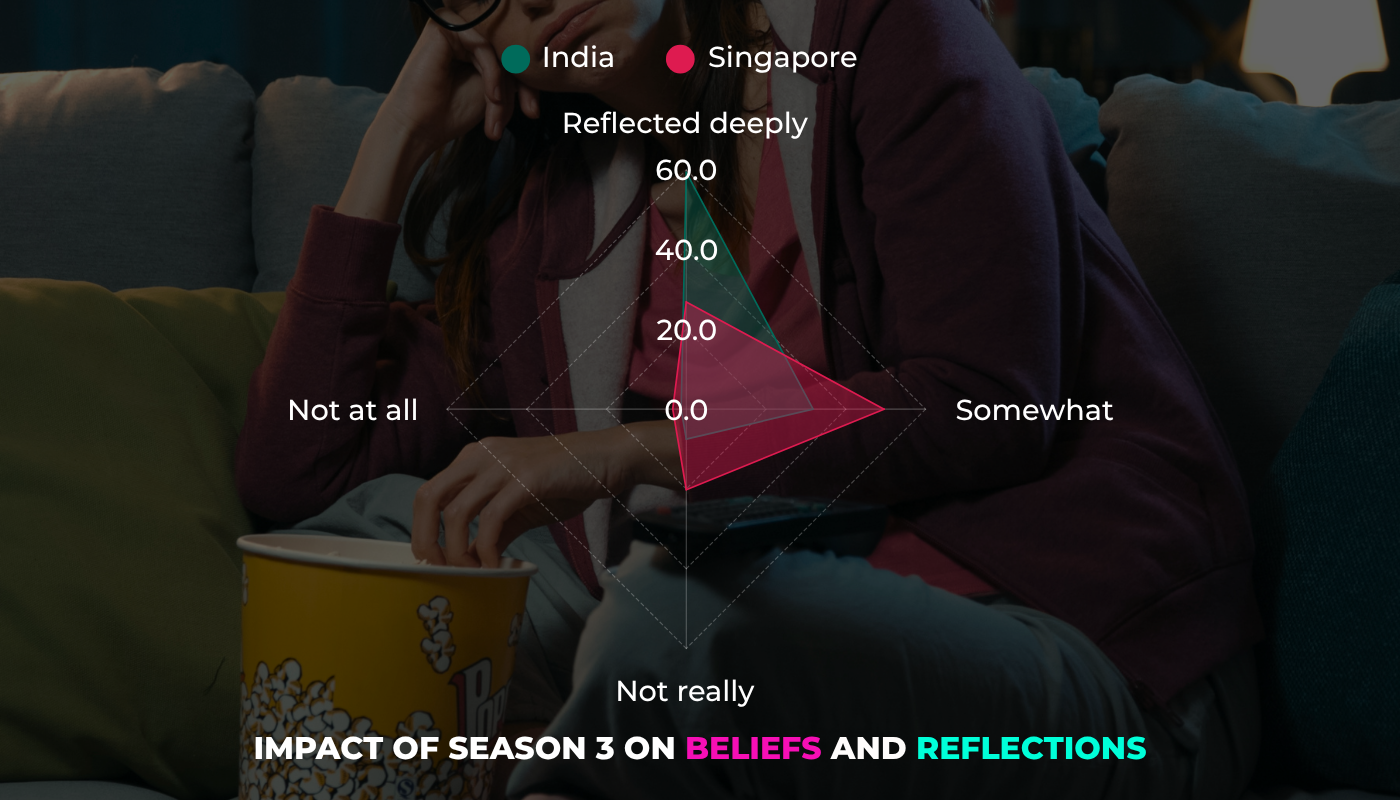

Indian viewers: Reflecting real-world struggles

Over 91% of Indian respondents said Squid Game Season 3 prompted them to reflect-either strongly or somewhat-on complex human issues such as morality, survival instincts, and ethical choices under pressure. The morally ambiguous actions and emotional conflicts of the characters didn’t just serve the plot; they struck a personal chord. For many Indian viewers, the show felt like a mirror to real-life experiences, highlighting themes of inequality, desperation, and societal pressure-making it much more than just entertainment.

Singaporean viewers: More thoughtful than emotionally immersed

In Singapore, the emotional impact of Squid Game Season 3 appeared more muted. Just 26.9% of respondents said the show prompted deep reflection, while 23.6% admitted it didn’t make them think much at all. This points to the possibility that the series was seen more as a piece of dark fiction than as a vehicle for moral or social commentary.

Cultural differences likely influence how themes like violence and moral ambiguity are received, leading to a more analytical or entertainment-focused viewing experience rather than a deeply emotional one.

Emotional response and post-viewing reactions

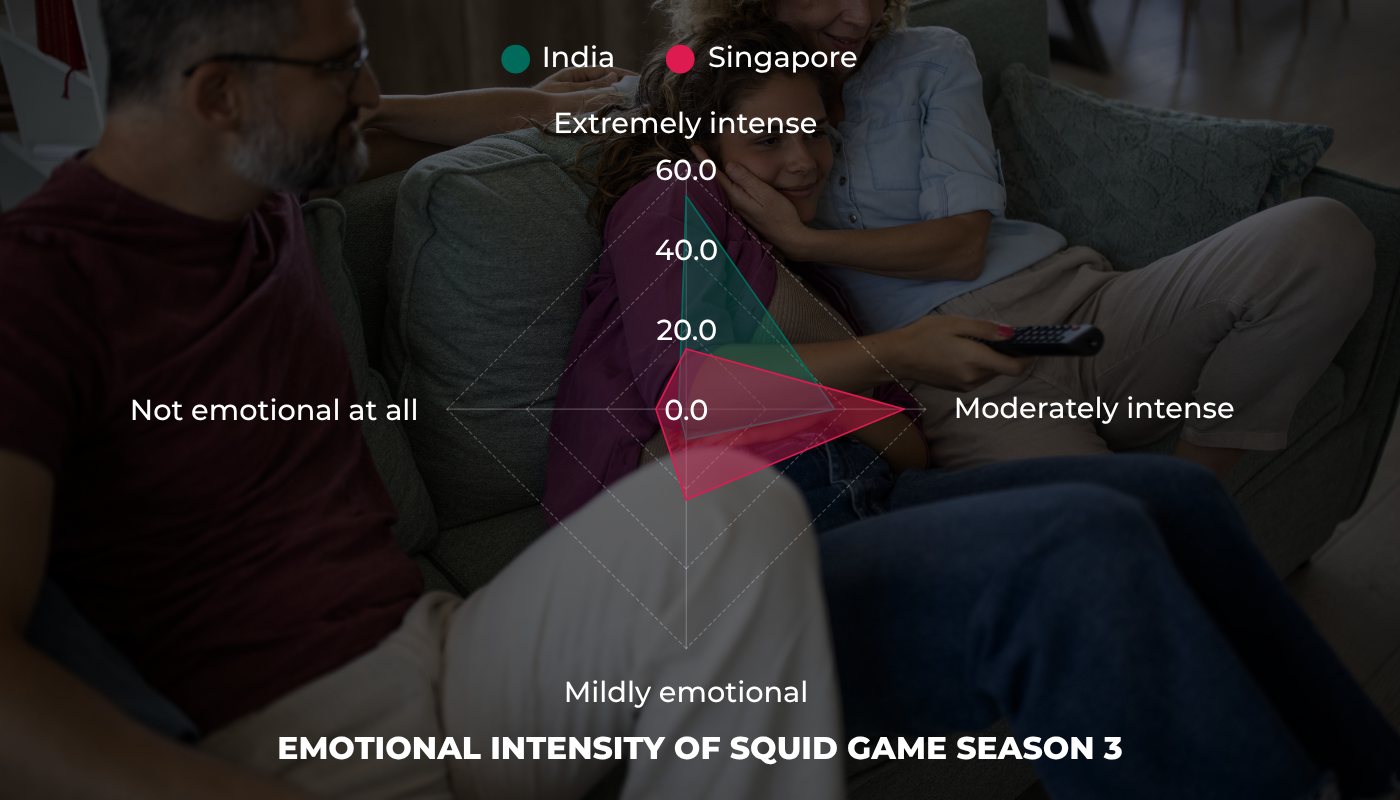

Squid Game 3 stirred strong emotions in India, but had a milder impact in Singapore

The emotional impact of Squid Game Season 3 varied significantly between the two countries. In India, more than 90% of viewers found the season emotionally intense, with 53.4% describing it as deeply moving. This wasn’t just casual viewing-the series clearly hit an emotional nerve. The powerful themes, dramatic character arcs, and life-or-death scenarios left a lasting impression on Indian audiences.

By contrast, Singaporean viewers responded with more restraint. Only 15.1% said they found the show extremely emotional, while a majority (54.6%) described the experience as moderately intense. Interestingly, over 30% reported little to no emotional reaction, marking a sharp contrast to the Indian response. These findings suggest that while Singaporeans followed the storyline, they were more emotionally detached-perhaps viewing the show more as gripping fiction than as something that personally resonated.

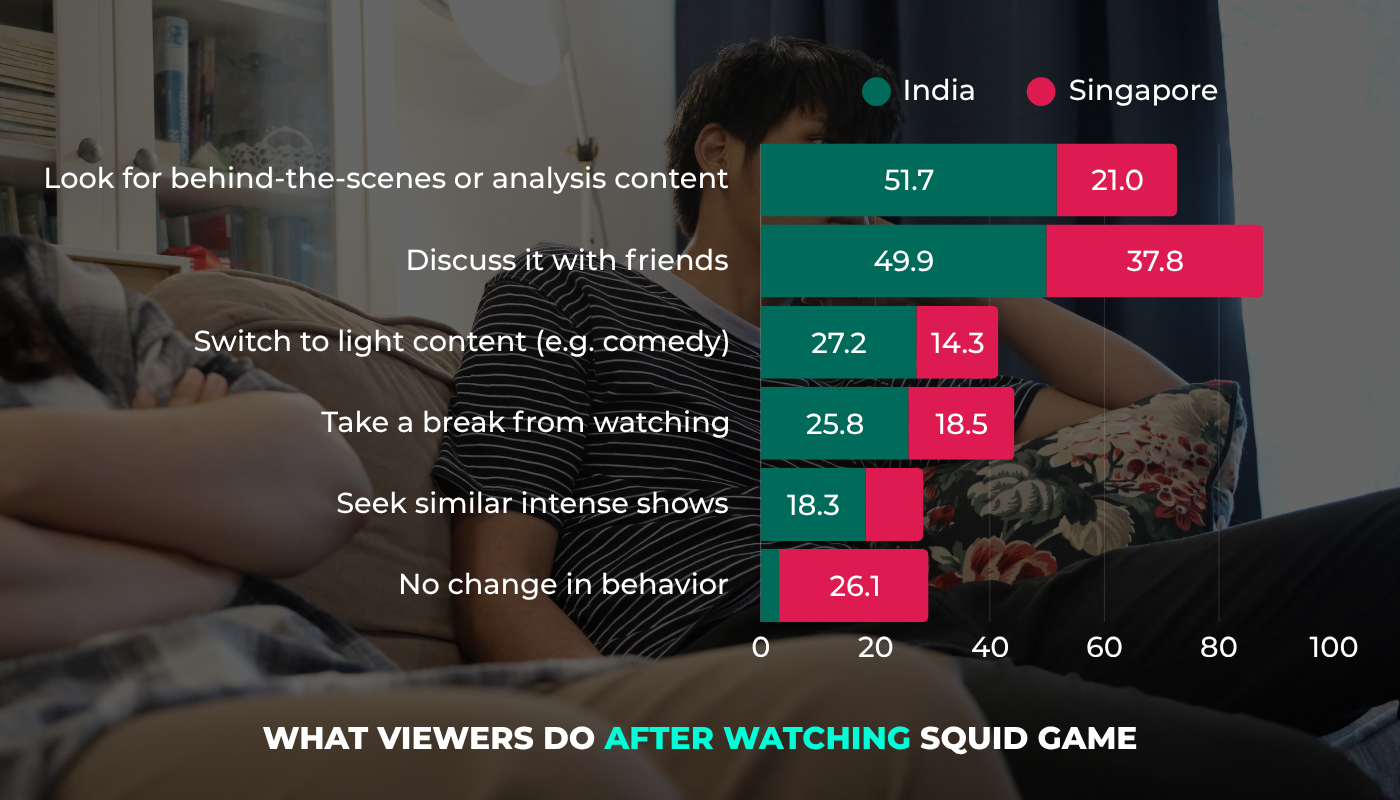

Indian viewers sought meaning and emotional resolution beyond the screen

For many Indian audiences, the emotional impact of Squid Game Season 3 didn’t stop when the season ended-it lingered. Over half (51.7%) actively searched for behind-the-scenes content or episode analyses to gain deeper insight into the storyline. Nearly half also discussed the show with friends, highlighting a strong social component in how they processed its emotional weight.

Many also took steps to manage their emotions afterward:

- 27.2% chose to watch lighter content like comedy to decompress

- 25.8% took a break from watching altogether

- Interestingly, 18.3% sought out other intense shows, revealing a craving for similarly powerful narratives

These post-viewing behaviors reflect the show's lasting influence. It wasn’t just entertainment-it sparked reflection, conversations, and conscious efforts to manage emotional responses.

Singaporean viewers were more inclined to disengage after watching

In contrast, Singaporean audiences seemed to process Squid Game Season 3 in a more detached manner. Only 21% sought out analytical content post-viewing, and just 37.8% discussed the show with others-both notably lower than the engagement levels seen in India. Moreover, 26.1% reported no behavioral changes at all after watching, indicating a tendency to separate entertainment from emotional impact or perhaps a higher threshold for emotionally intense content.

The lower levels of follow-up engagement suggest a more compartmentalized approach to viewing. While Singaporean viewers may have found the show interesting, it didn’t seem to leave a lasting emotional mark or prompt further reflection or conversation.

Demographic factors behind Squid Game’s popularity

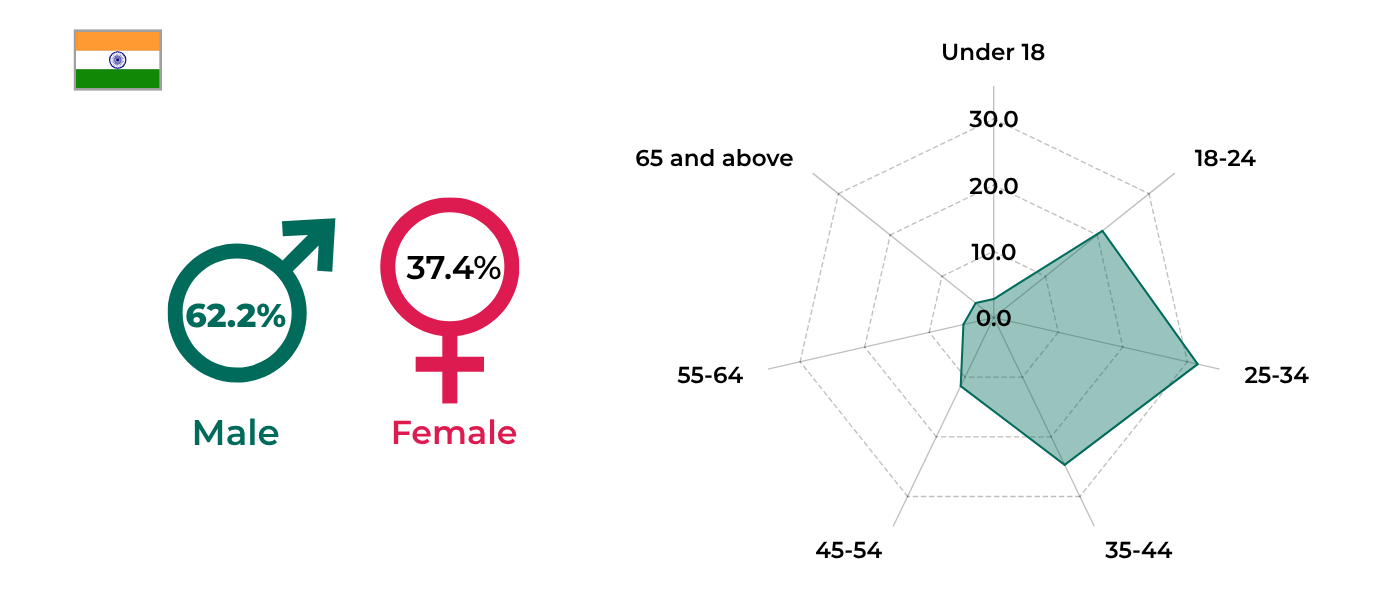

India: A young, male-skewed audience drives the show’s viral momentum

In India, more than 55% of respondents were under the age of 35, and 62.2% were male-a group typically linked to binge-watching habits, trend awareness, and strong digital savviness. These younger viewers often act as early adopters of viral content and are especially reactive to online hype. Many even accessed Squid Game through unofficial channels like Telegram or YouTube, reflecting a strong fear-of-missing-out (FOMO) culture where keeping up with trending shows is seen as essential for social connection.

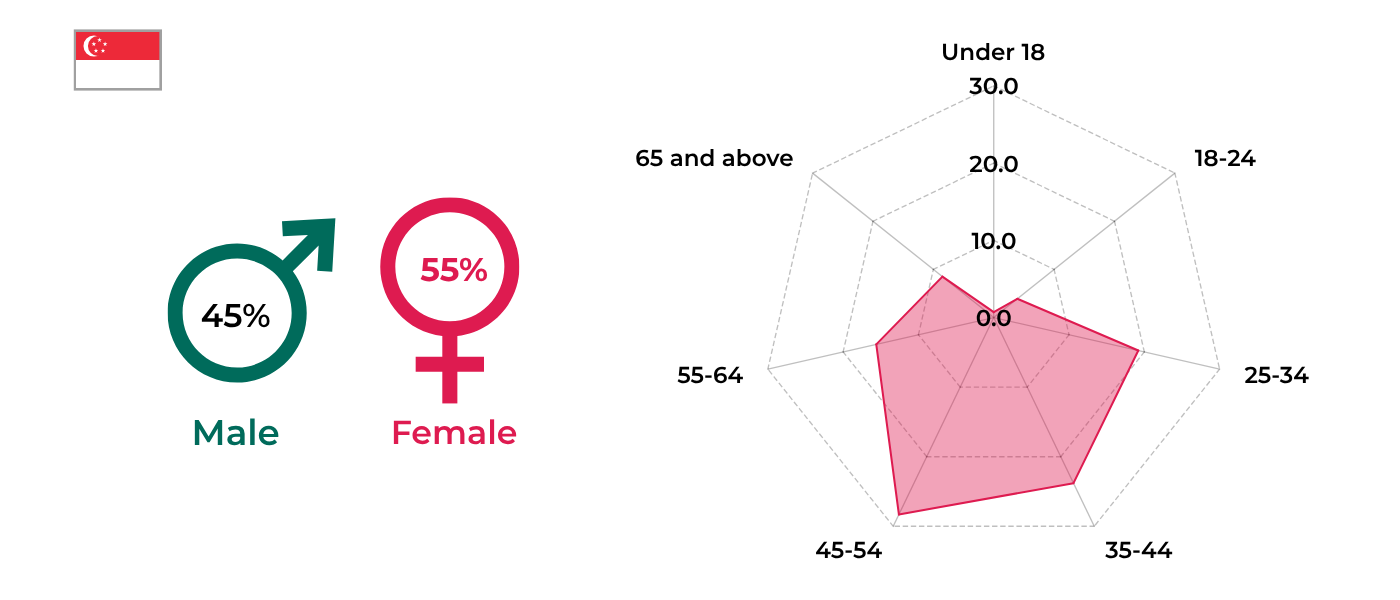

Singapore: Older viewers with more selective content preferences

In contrast, 52.4% of Singaporean respondents were aged 45 or older-a group that typically takes a more thoughtful and selective approach to what they watch. Although Squid Game enjoyed strong name recognition, many in this demographic opted out. The most common reasons were “not my type of show,” “don’t have Netflix,” and “too violent,” pointing to strong genre preferences and a lower tendency to follow viral trends. Still, those who did watch were more likely to finish all seasons, indicating that once engaged, they showed a high level of commitment.

Streaming behavior influences content engagement

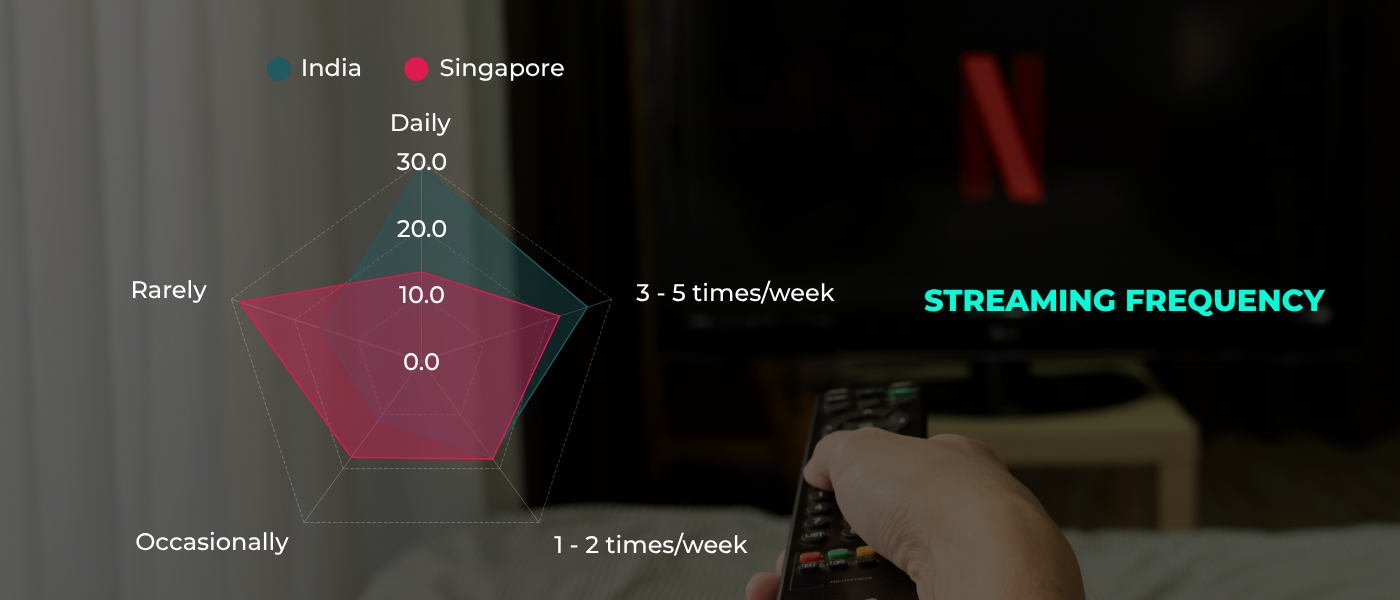

India: Streaming as a daily habit – Singapore: Streaming as occasional leisure

In India, streaming is deeply embedded in daily life. A significant 55.4% of respondents reported streaming content at least three times a week, with 29.2% watching daily. This shows that platforms like Netflix are more than just entertainment-they’re a key part of daily routines, whether for emotional escape, connection to cultural trends, or simple habit.

Singaporeans are more casual streamers

Compared to India, Singaporean viewers tend to stream less frequently. Only 35.2% reported streaming more than three times a week, and nearly a third (28.7%) said they rarely stream at all. For many, streaming is more of an occasional activity-something done on weekends or when a specific show piques their interest. This lighter, less routine viewing style may help explain why emotionally intense, buzz-driven series like Squid Game Season 3 had a more subdued impact in Singapore.

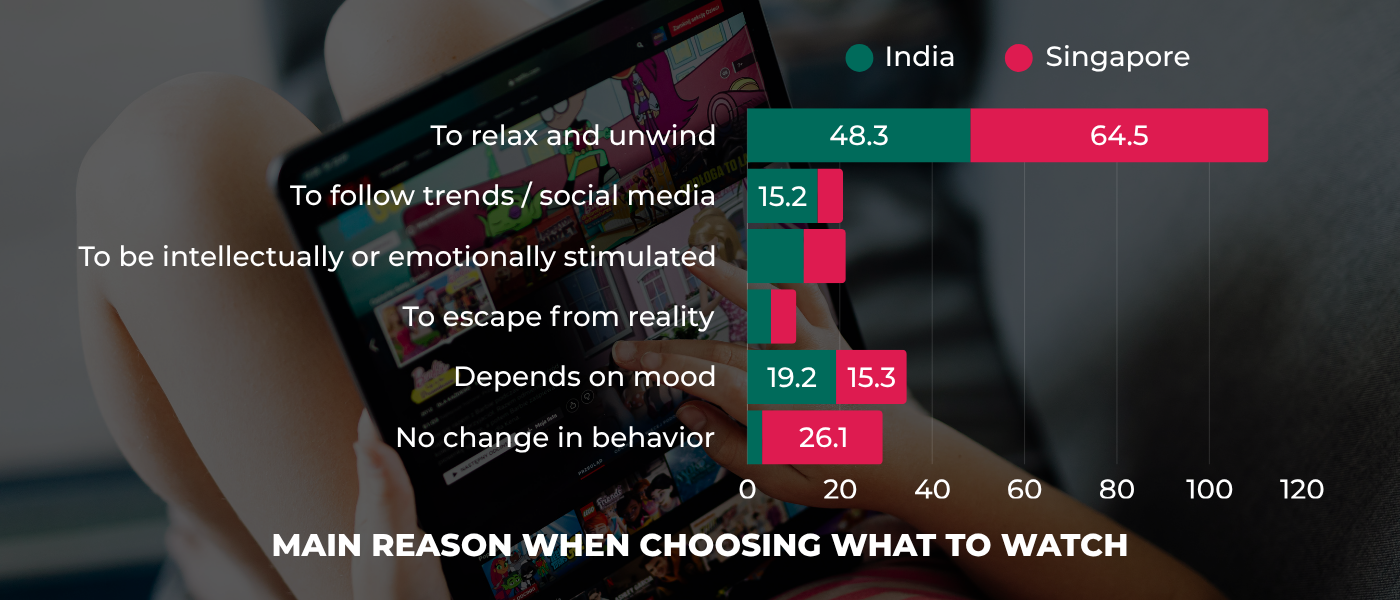

What motivates viewers to press “play” varies by country

While relaxation is the top reason for streaming in both markets, it plays a more dominant role in Singapore, where 64.5% say they watch primarily to unwind. In India, that figure is lower at 48.3%, and additional motivations are more prominent. About 15.2% of Indian viewers stream to stay up-to-date with trends or social media chatter, while 12.2% seek emotional or intellectual stimulation-indicating a more purposeful and engaged approach to choosing what to watch.

This contrast in viewing motivation helps clarify why Indian audiences were more inclined to engage with the moral and ethical themes of Squid Game, while Singaporean viewers largely treated it as a form of escapism. Content that explores social issues or nuanced human behavior tends to resonate more with viewers who actively seek out thoughtful, challenging narratives-and in this case, those viewers were significantly more prevalent in India.

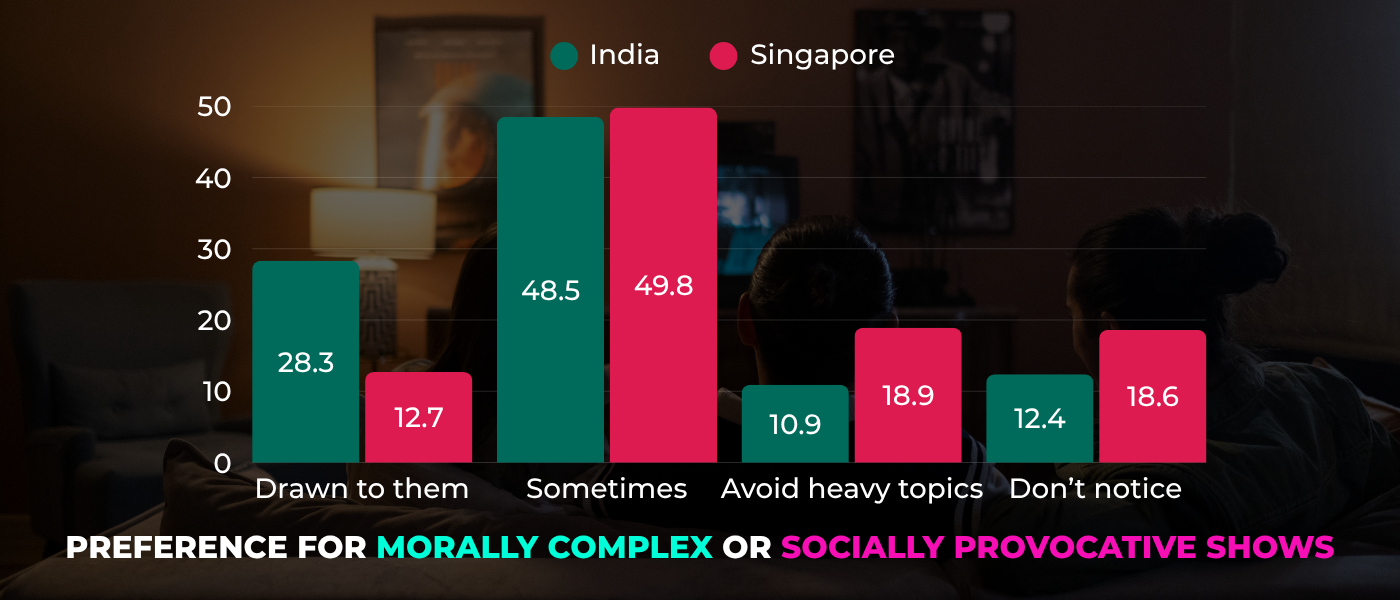

Indian audiences gravitate toward morally complex storytelling

When asked whether they seek out shows with morally complex or socially provocative themes, 28.3% of Indian respondents said yes-they’re actively drawn to that kind of storytelling. Another 48.5% said sometimes, bringing the total to 76.8% who are open to deeper, thought-provoking content.

In contrast, only 12.7% of Singaporean viewers said they actively seek such themes, and nearly 1 in 5 (18.9%) admitted they intentionally avoid heavier topics. This underscores a consistent pattern throughout the findings: Singaporean audiences tend to be less emotionally invested, less driven by trends, and less inclined to engage with morally grey or intense narratives.

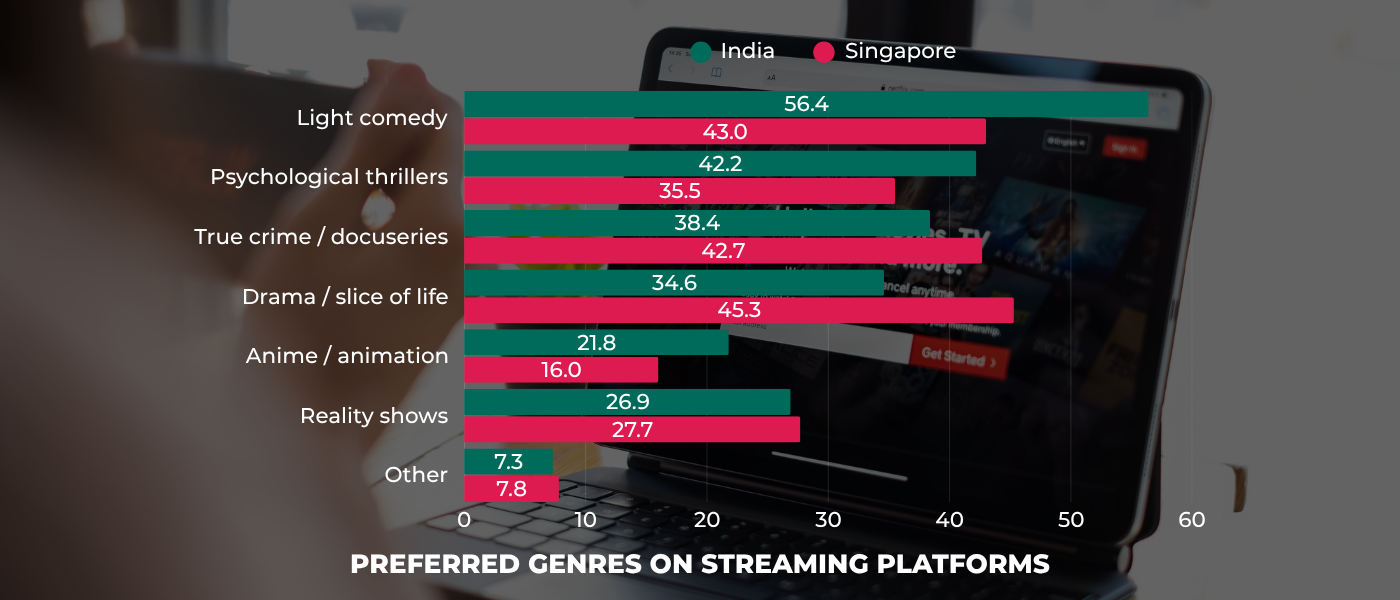

Different genre preferences reflect different emotional appetites

When it comes to genre, Indian viewers show a strong appetite for variety and emotional depth. While over half (56.4%) enjoy light comedy, many are equally drawn to darker or more serious formats:

- 42.2% enjoy psychological thrillers

- 38.4% watch true crime or docuseries

- 34.6% prefer drama or slice-of-life stories

This mix suggests that Indian audiences are comfortable shifting between lighthearted entertainment and emotionally intense storytelling-they’re open to both comfort and confrontation.

Singaporean viewers, on the other hand, favor realism and emotional grounding. Their top genres include:

- Drama or slice of life (45.3%)

- True crime / docuseries (42.7%)

- Light comedy (43%)

There’s noticeably less interest in thrillers or high-intensity formats. This preference for grounded narratives with gentle pacing may explain why Squid Game 3-with its psychological pressure, fast pace, and high-stakes tension-had a more muted emotional impact in Singapore.

Trends drive viewing in India – discovery drives it in Singapore

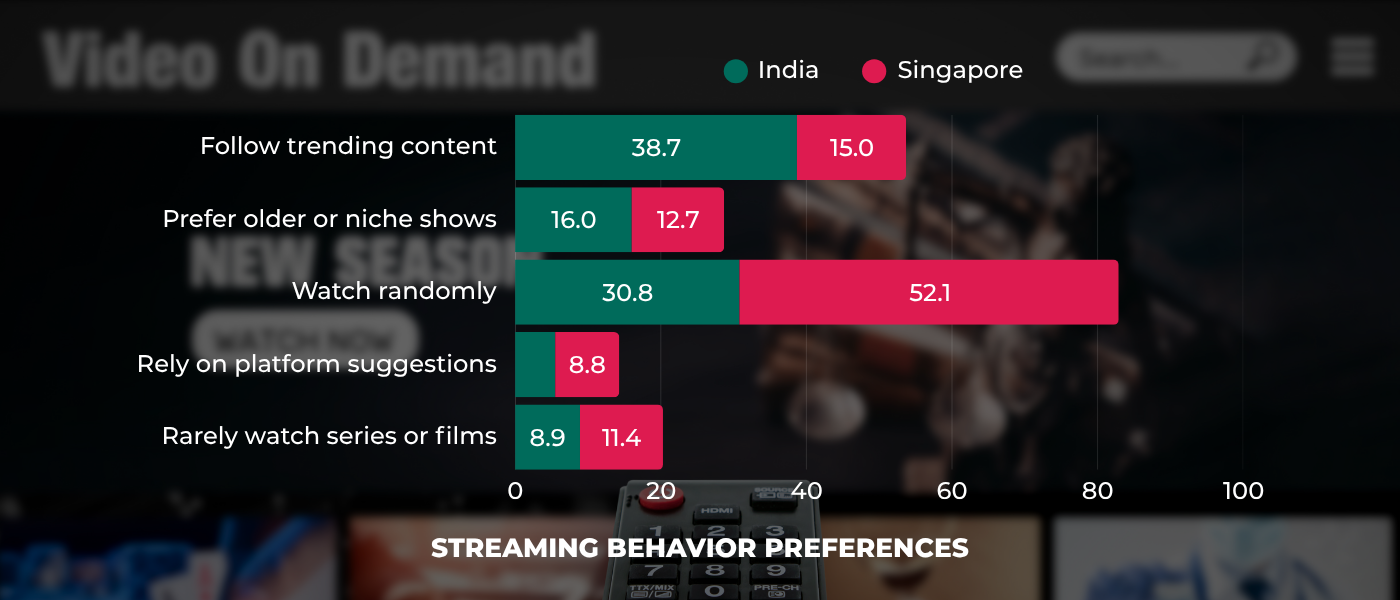

Another major difference lies in how viewers decide what to watch. In India, 38.7% of respondents say they follow what's trending online-meaning social media buzz, peer recommendations, and cultural conversations play a major role in content discovery. An additional 30.8% watch randomly based on whatever grabs their attention, which still favors shows that dominate platform homepages or recommendation carousels.

In Singapore, viewers are far less trend-driven. Only 15% follow online trends, while a majority (52.1%) say they decide what to watch in the moment, often browsing without a plan and clicking on whatever looks interesting. This suggests that even a globally popular title like Squid Game must compete based on immediate appeal or platform curation-not just social buzz-when trying to attract Singaporean viewers.

Conclusion

Squid Game Season 3 became a global hit-but it didn’t land the same way everywhere. In India, passionate young viewers fueled online buzz and emotional engagement. In Singapore, the audience was more selective and less influenced by hype, but those who did start watching often stuck with it through to the end.

These differences reflect a bigger truth: how we engage with content is deeply shaped by culture, emotion, and media habits.

Want to share your own opinion?

Join Z.com Research to take fun, rewarding surveys and make your voice heard. Your insights help shape the future of entertainment and show creators what truly matters to audiences like you.