Information

- News

- newRelease

- [Market Report] Inflation Impact on Household Finance

[Market Report] Inflation Impact on Household Finance

- 2024/05/23

- newRelease

Inflation, the rising cost of goods and services, is a pressing concern for individuals and policymakers alike. While its effects are felt across the economy, households are particularly vulnerable as inflation erodes purchasing power and disrupts financial planning. This report delves into the multifaceted impact of inflation on household finance.

We will explore how inflation squeezes household budgets, and forcing adjustments in spending habits. The report will examine how different income groups are disproportionately affected, with low-income households often bearing the brunt of rising essential good prices.

Furthermore, the report will explore the potential measures and preferred investment options that mitigate the negative impacts of inflation. By understanding the intricacies of inflation's influence on household finance, we can be better equipped to manage its challenges and promote financial resilience.

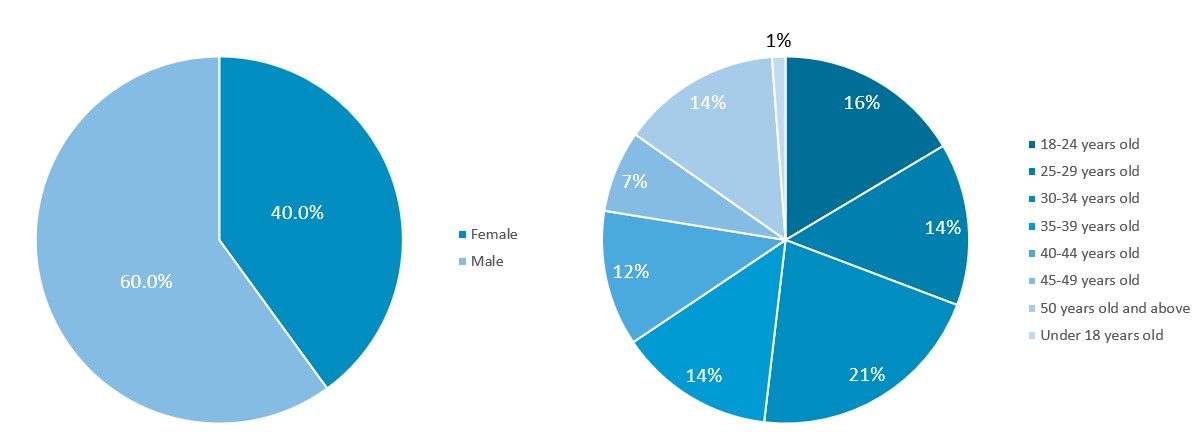

Respondents' Demographic

The survey sample is predominantly female (60%), and the age group 30-34 is the most represented (21.1%), indicating a focus on working-age adults. This demographic is particularly relevant in India, where there is a growing trend of female participation in the workforce, especially in urban areas.

The age distribution reflects a young and economically active population, which is significant given India's demographic dividend and the increasing financial independence among younger generations.

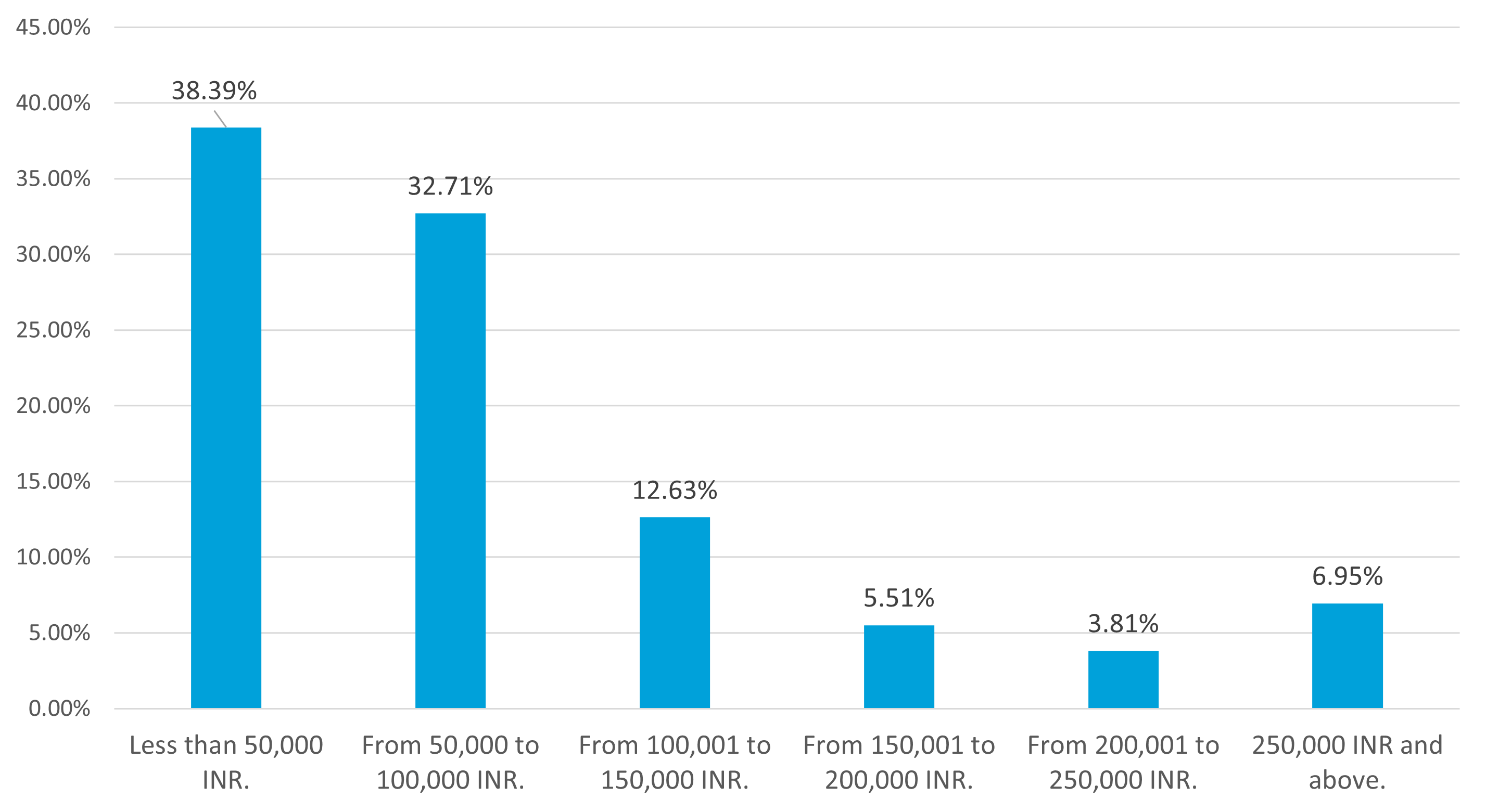

Monthly Household Income

A significant proportion of respondents (38.39%) have a household income of less than 50,000 INR, indicating a lower-middle-income demographic. This is reflective of the larger Indian middle class, which, while growing, still faces significant financial constraints. The income distribution underscores the economic diversity in India, where a large segment of the population is still striving to move up the economic ladder.

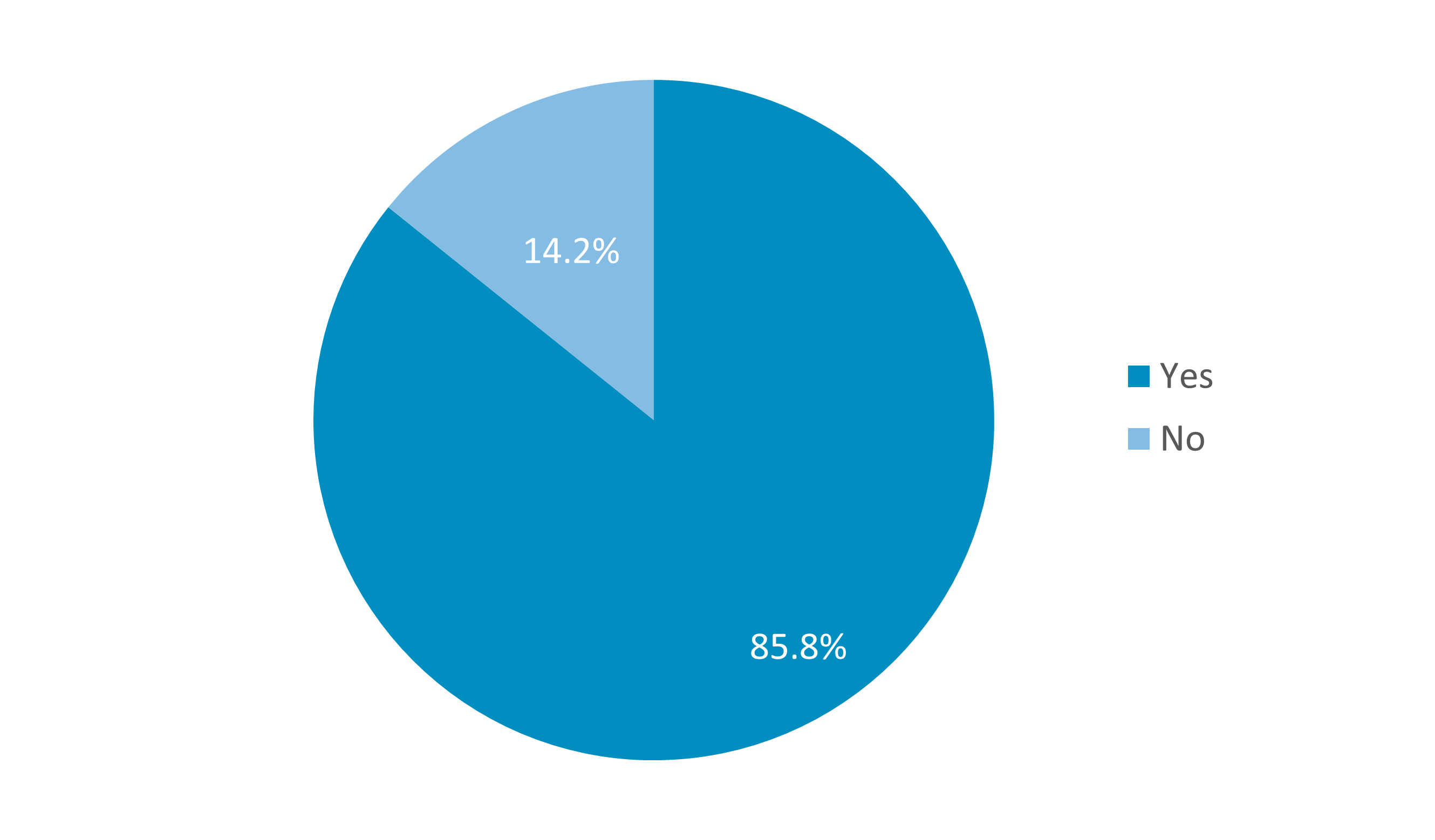

Awareness of Global Inflation

A majority of respondents (85.8%) are aware of the impact of global inflation on household finances, showing a high level of financial awareness. This awareness is crucial in a country like India, where inflation can significantly impact daily life due to the large proportion of household budgets spent on essentials such as food and transportation.

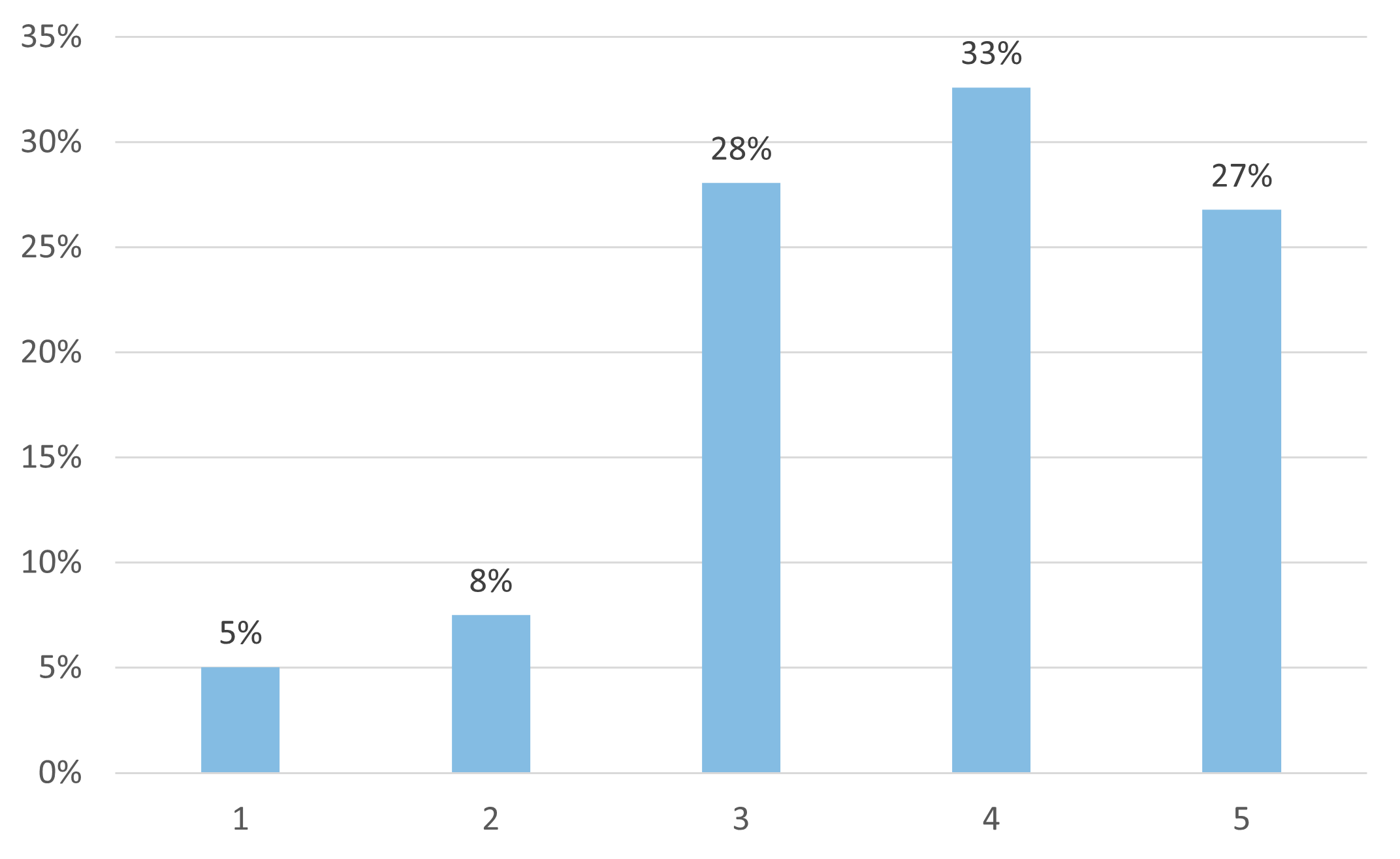

Impact of Global Inflation on Household Finances

On a scale of 1 to 5, with 1 being "Not at all affected" and 5 being "Severely affected"

Most respondents feel a significant impact from global inflation, with 33% rating it as a 4 and 27% as a 5 on the severity scale.

This high perceived impact is indicative of the sensitivity of Indian households to price changes, especially given the country's relatively high inflation rates. It reflects the economic reality where inflation erodes purchasing power, affecting the ability to afford basic necessities.

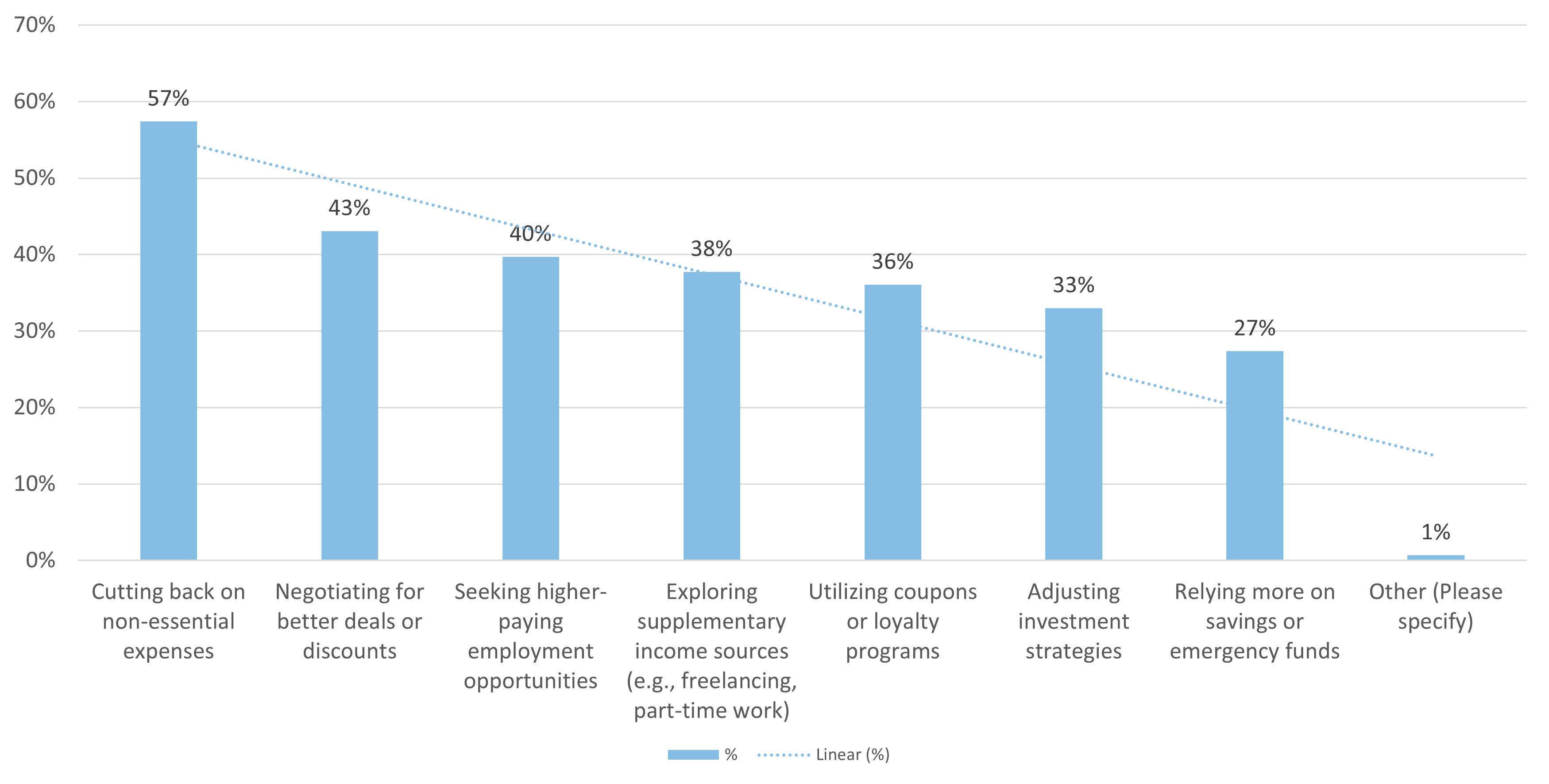

Measures Taken to Mitigate the Impact of Inflation

The most common measure is cutting back on non-essential expenses (57%), followed by negotiating for better deals (43%).

This is consistent with Indian cultural values of frugality and resourcefulness. The significant percentage of respondents seeking higher-paying jobs (40%) and supplementary income (38%) reflects the entrepreneurial spirit prevalent in India, where individuals often look for multiple income streams to secure their financial future.

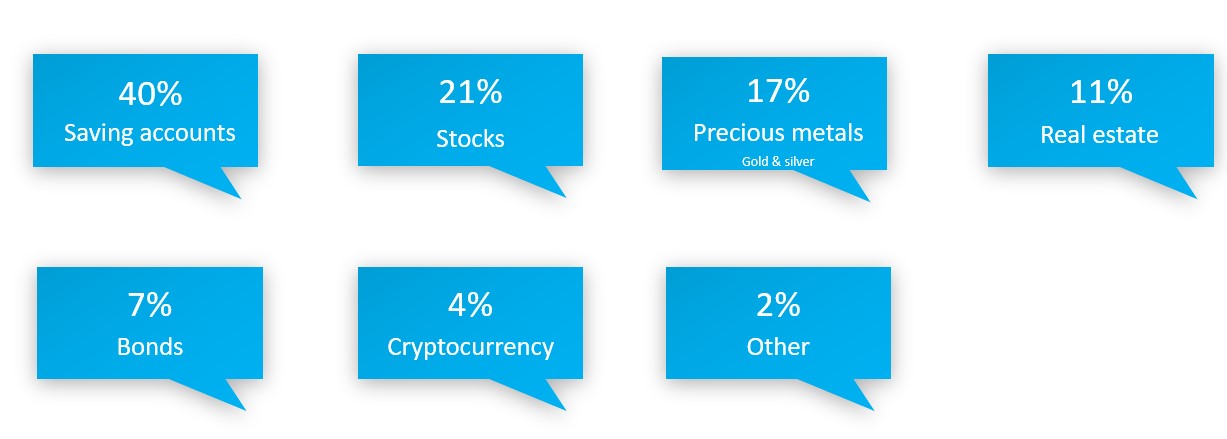

Preferred Investment Options Amidst Inflation

Savings accounts (40%) are the most preferred investment option, indicating a conservative approach during inflation.

This preference is rooted in the traditional Indian emphasis on the safety and liquidity of assets, especially in uncertain economic times. The interest in precious metals (17%) also aligns with cultural practices, as gold and silver are considered safe havens and have intrinsic cultural value in India.

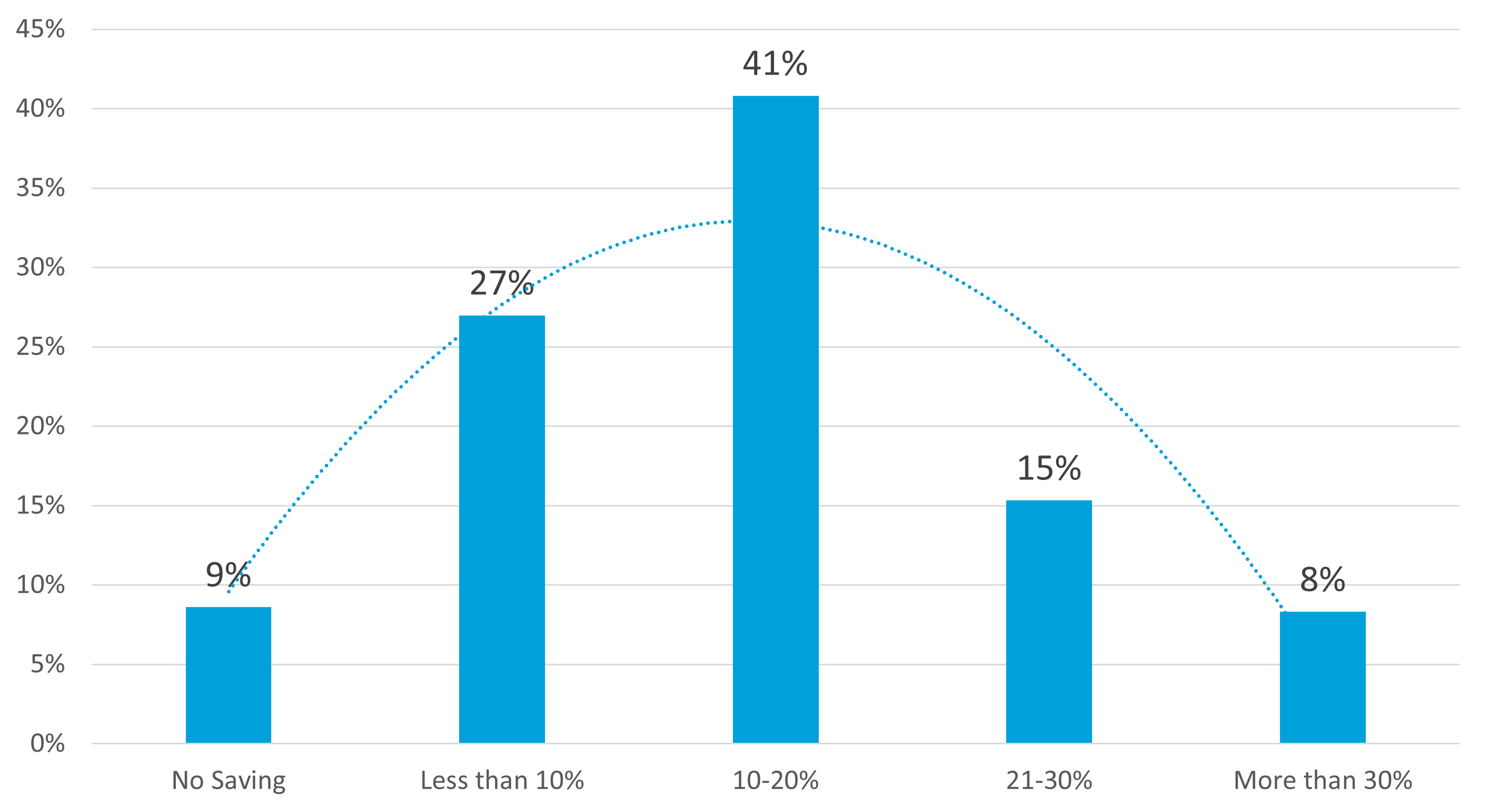

Monthly Income Savings Percentage

A significant portion of respondents save 10-20% of their income (41%), showing a moderate saving habit.

This is reflective of the traditional Indian emphasis on saving and financial prudence, often driven by the desire to secure future financial stability and to meet cultural obligations such as weddings and festivals.

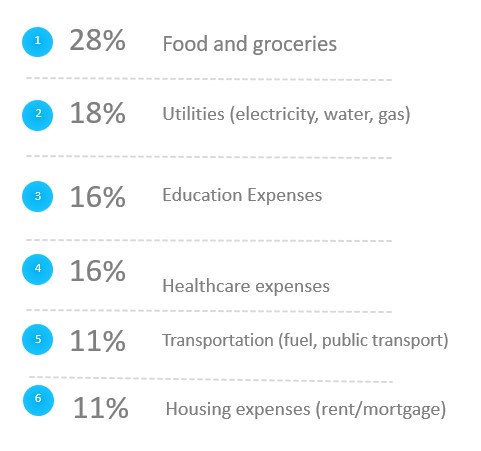

Anticipated Areas Most Affected by Inflation

Food and groceries (28%) are anticipated to be the most affected areas by inflation, followed by utilities (18%). This is particularly relevant in India, where a significant portion of household income is spent on food, and rising food prices can have a substantial impact on living standards.

Concern about utilities and healthcare expenses also highlights the critical areas where inflation can strain household budgets.

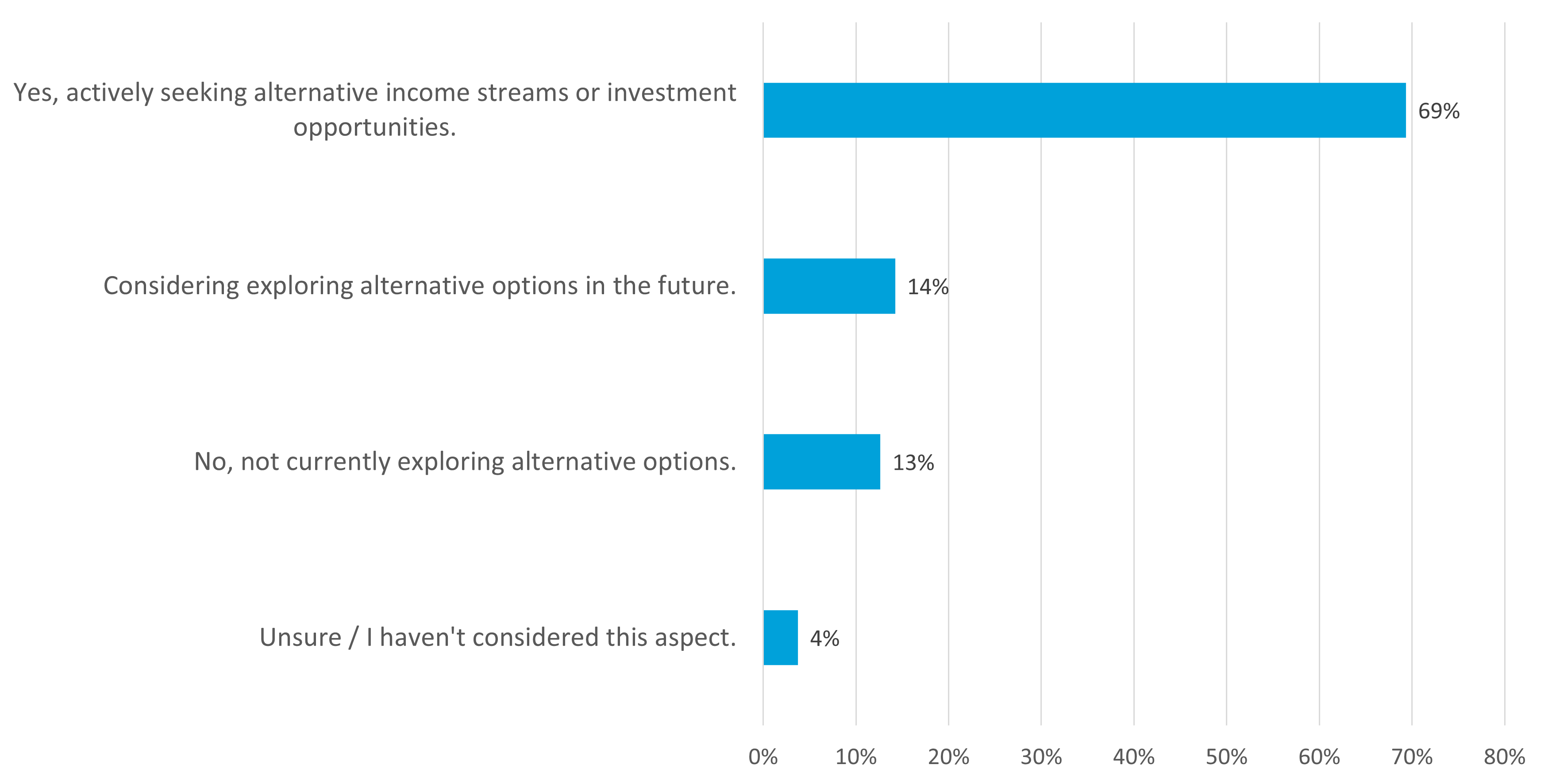

Exploration of Alternative Income Streams or Investment Opportunities

A majority (69%) are actively seeking alternative income streams or investment opportunities, reflecting proactive financial behavior.

This trend is indicative of the growing awareness and willingness among Indians to diversify their income sources, a necessary strategy in an inflationary environment to maintain financial resilience.

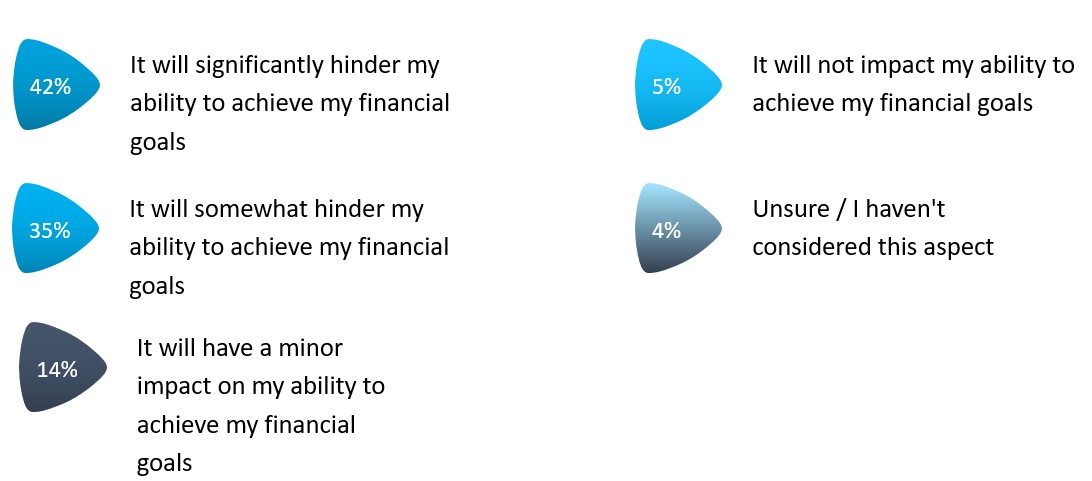

Impact of Inflation on Financial Goals

42% believe inflation will significantly hinder their ability to achieve financial goals, highlighting widespread concern.

This reflects the challenge that inflation poses to long-term financial planning in India, where savings and investments must be carefully managed to counteract the erosion of value due to rising prices.

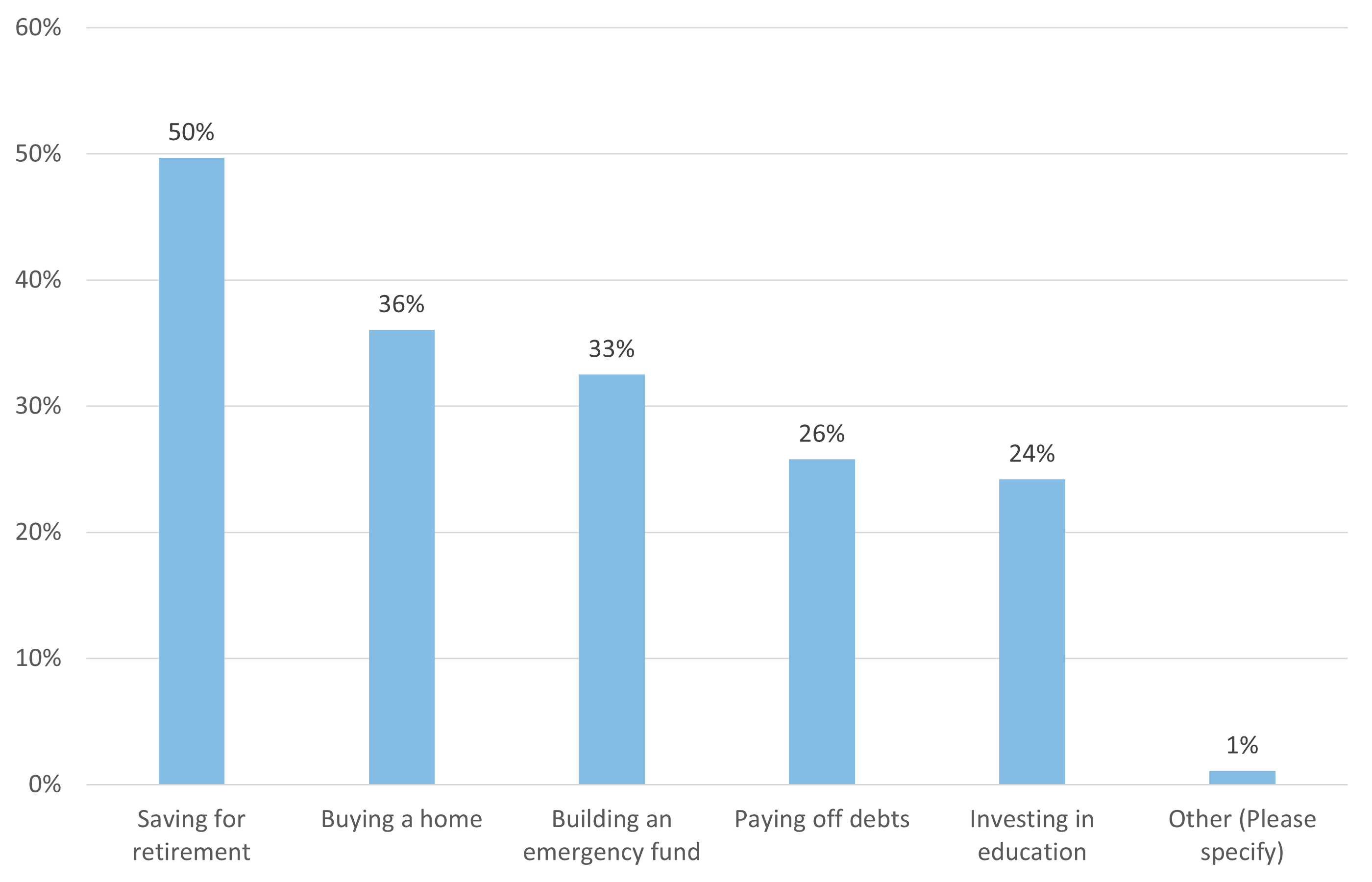

Primary Financial Goals for the Next 5 Years

Saving for retirement (50%) is the top financial goal, indicating a long-term financial planning focus among respondents.

This goal is particularly significant in India, where the absence of a robust social security system necessitates substantial personal savings for retirement.

Buying a home (36%) also remains a major aspiration, reflecting the cultural importance of property ownership as a symbol of stability and success.

Conclusion

The survey reveals a high level of awareness regarding global inflation among Indian households, who are significantly concerned about its impact on finances.

Most respondents are taking measures to mitigate this impact, primarily by cutting non-essential expenses and seeking better financial deals. Savings accounts are the preferred investment during inflationary periods, reflecting a cautious approach consistent with Indian cultural values.

There is a general proactive stance towards exploring alternative income sources. However, there is widespread concern that inflation will hinder achieving financial goals, with a strong focus on saving for retirement and building an emergency fund. This aligns with the traditional emphasis on financial prudence and long-term security, underscoring the cultural and economic resilience of Indian households.

![[Market Report] Inflation Impact on Household Finance|newRelease|News|Z.com Research India Home Page](/theme/ZRID/img/siteLogo.svg)