Evolving Vending Machine: A New Era of Consumer-Centric Retail

The vending machine landscape is witnessing a remarkable evolution across Thailand, India, Malaysia, and Singapore. No longer confined to mere snacks and beverages, these retail solutions are now intricately tailored to meet the multifaceted needs of today's consumers. This comprehensive report, based on a survey of 4,052 consumers across these nations, sheds light on pivotal findings and offers actionable strategies to enhance vending machine operations effectively.

1. Demographic Overview

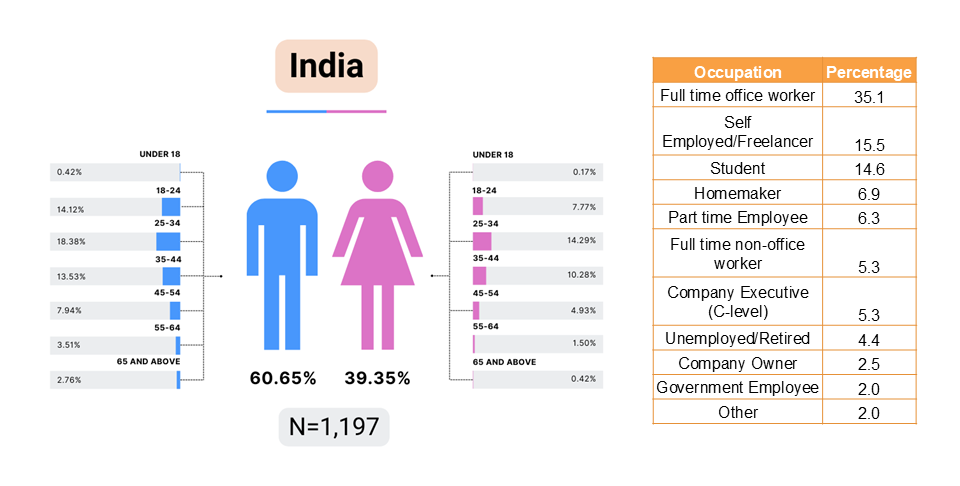

In this survey, 1,197 Indian users participated, revealing a predominantly male demographic, with 60.7% identifying as male. The age demographics reflect a vibrant, youthful energy, with 32.7% of respondents aged 25-34. Additionally, a significant majority of respondents, 35.1%, identified as full-time office workers.

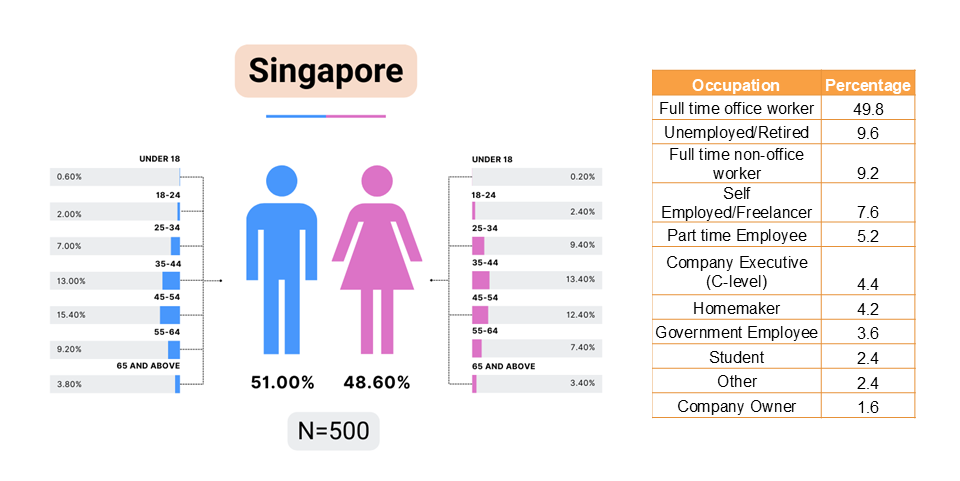

The Singaporean sample consisted of 500 users, showcasing a balanced representation with 51% male and 48.6% female respondents. Age demographics in Singapore skew older, with 27.8% of participants in the 45-54 bracket. Notably, a significant 49.8% of respondents identified as full-time office workers.

In Malaysia, 1,202 users took part in the survey, with a male skew of 55.8%. The age group of 35-54 is prominently represented, comprising 55.1% of the respondents. A significant majority, 40.3%, identified as full-time office workers.

In Malaysia, 1,202 users took part in the survey, with a male skew of 55.8%. The age group of 35-54 is prominently represented, comprising 55.1% of the respondents. A significant majority, 40.3%, identified as full-time office workers.

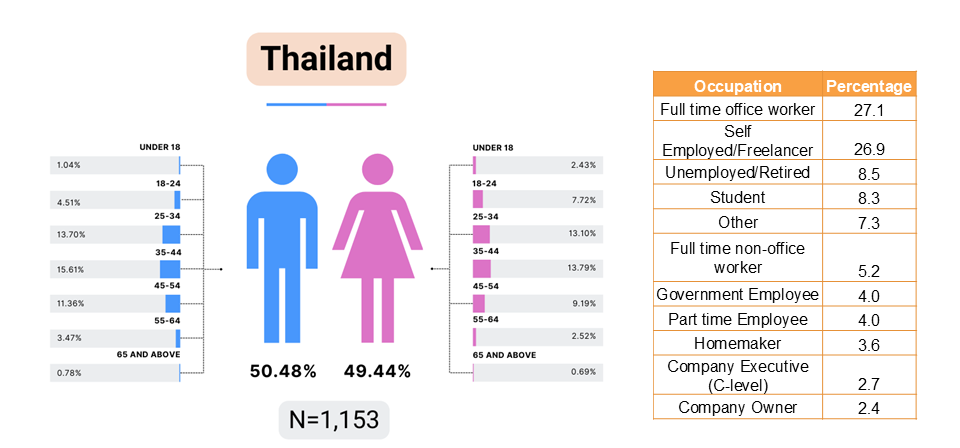

Finally, 1,153 Thai users participated in the survey, presenting a nearly balanced gender distribution at 50.5% male and 49.5% female. The age group of 35-54 is particularly prominent, representing 50.0% of respondents. The majority of participants identified as full-time office workers at 27.1%, alongside a considerable percentage of self-employed or freelancers at 26.9%.

2. Patterns of Vending Machine Usage: Frequency and Motivations

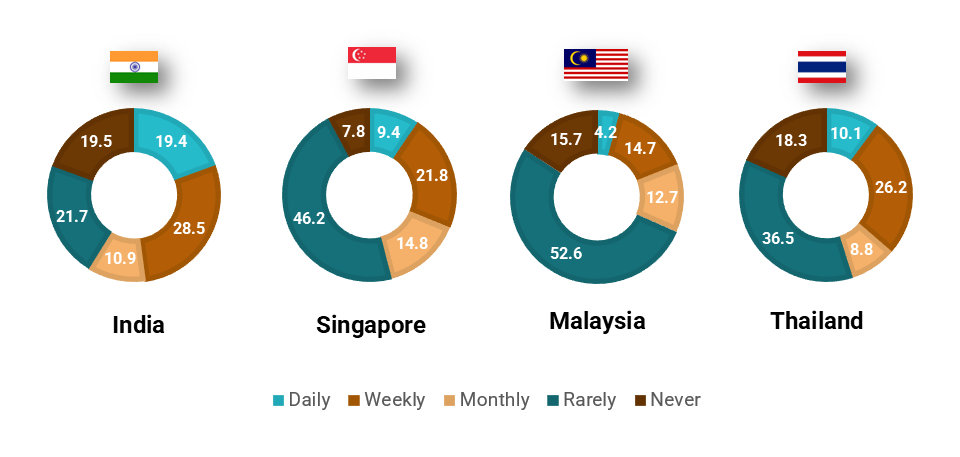

Usage patterns reveal interesting insights into consumer behaviors. Indians are the most frequent users, with 19.4% reporting daily use, followed by Thailand at 10.1%. In contrast, Malaysia has a striking 52.6% of respondents using vending machines rarely, suggesting potential roadblocks to widespread adoption. Singapore presents a mixed landscape, with 9.4% of respondents utilizing vending machines daily, yet a substantial 46.2% engage rarely.

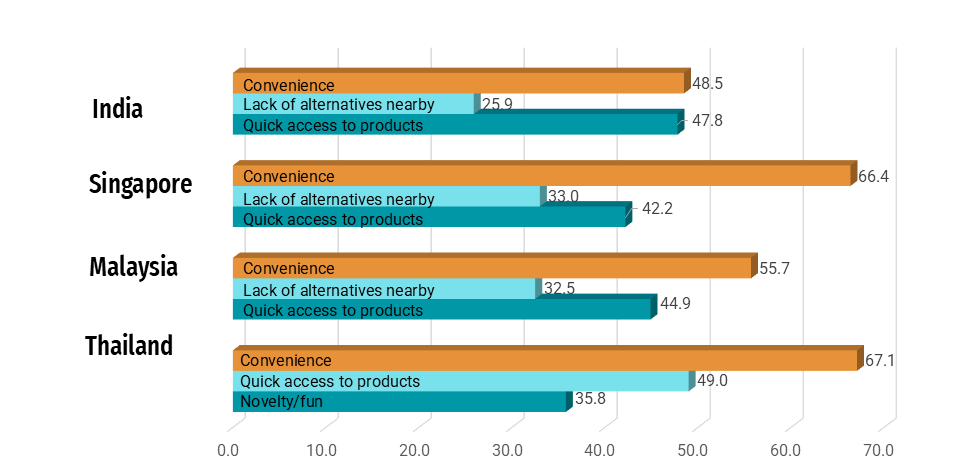

The driving motivations for using vending machines show consistent themes across regions, with convenience as the primary factor. In Thailand, 67.1% cite convenience, closely followed by Singapore at 66.4%. Malaysia emphasizes convenience at 55.7%, while India reports 48.5%. Quick access to products also highlights its crucial role in consumer decision-making. Many consumers in India, Singapore and Malaysia also rely on vending machines due to a lack of nearby alternatives, which indicates an opportunity for operators to position machines strategically in underserved areas. Furthermore, novelty has emerged as a compelling motivation in Thailand, where 35.8% of consumers appreciate the engaging and innovative nature of modern vending options.

3. Snack and Beverage Preferences: Regional Taste Profiles

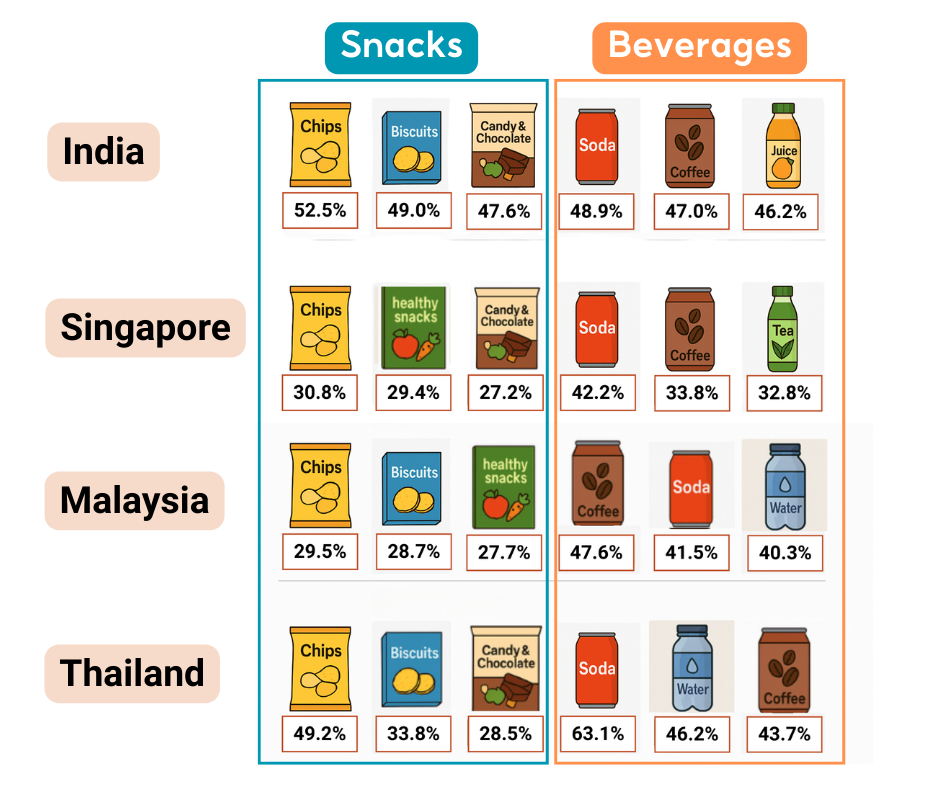

Consumer preferences for snacks and beverages from vending machines reveal intriguing regional trends across four countries: India, Singapore, Malaysia, and Thailand. Chips dominate as the favorite snack in all regions, with India (52.5%) and Thailand (49.2%) showing particularly strong preferences. Biscuits also rank highly in India, Malaysia, and Thailand, while Singaporeans and Malaysians lean toward healthier snacks. Interestingly, Indians and Thais have a sweet tooth, opting for candy and chocolates (47.6% and 28.5%, respectively).When it comes to beverages, soft drinks are the top choice in India (48.9%), Singapore (42.2%), and Thailand (63.1%). In Malaysia, coffee ranks highest at 47.6%, likely due to the 78.9% of respondents aged 25-54, who seek caffeine to stay energized at work. Both soft drinks and coffee are among the top three choices in all four countries. Additionally, India shows a strong preference for juices, reflecting a taste for refreshing beverages, while Singapore favors tea, indicating a cultural inclination towards this calming drink. Water stands out as a staple choice in both Thailand and Malaysia.

4. Expanding Horizons: Beyond Snacks and Beverages

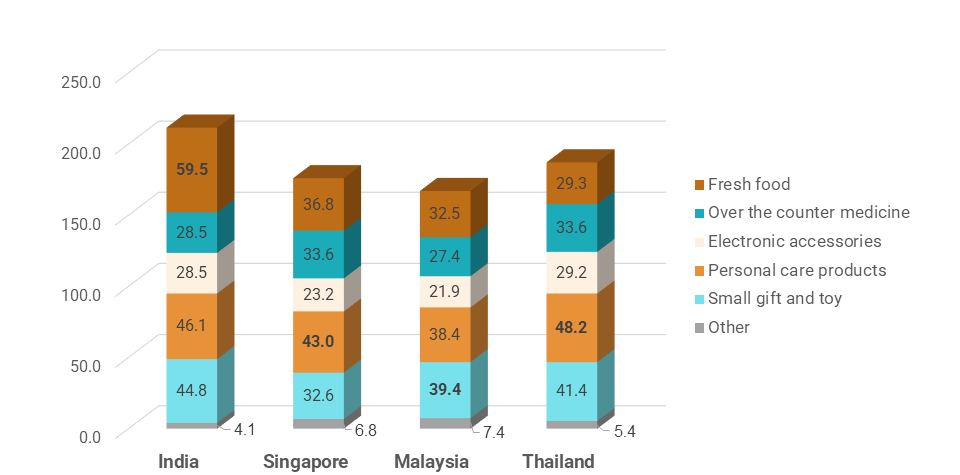

The survey insights extend beyond traditional snack and beverage offerings, with consumers expressing interest in fresh food, personal care products and small gifts/toys. In India, 59.5% of respondents are keen on health-focused vending solutions that provide fresh and nutritious options. In Thailand and Singapore, the appeal of personal care products (48.2% and 43,0% respectively) indicates a broader market potential for self-care items, while the demand for small gifts and toys in Malaysia (39.4%) points towards unique opportunities for engaging younger consumers.

5. Strategic Locations and Payment Preferences: Maximizing Accessibility

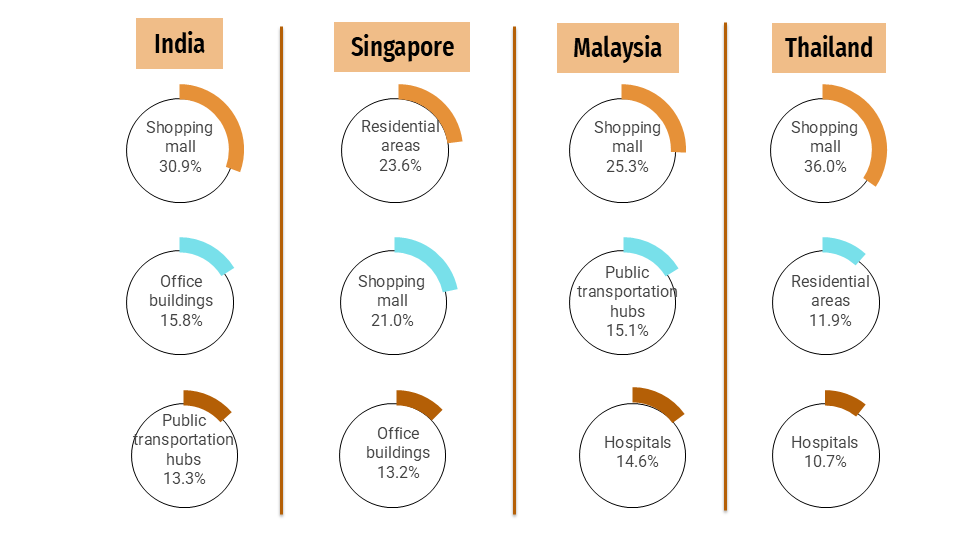

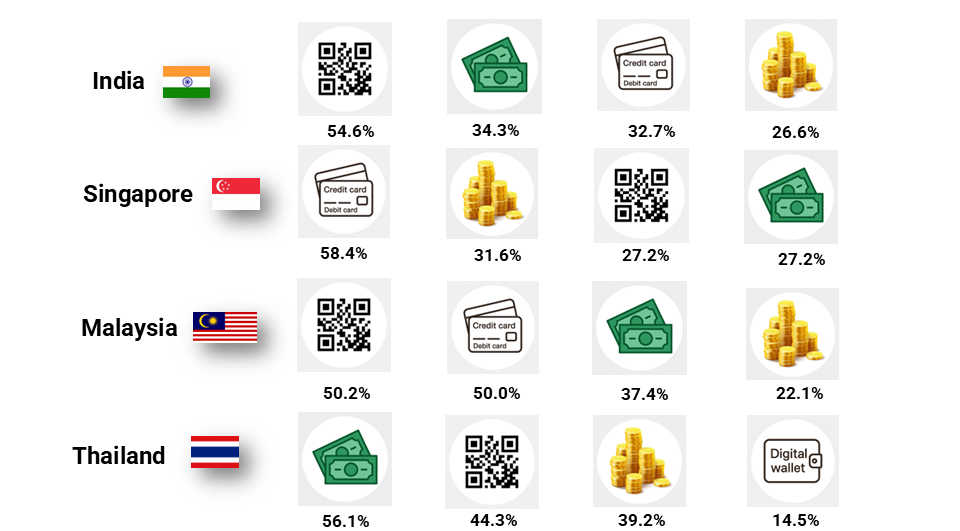

Strategically, shopping malls are identified as the top location for vending machine use, especially in India (30.9%), Thailand (36%) and Malaysia (25.3%). This finding emphasizes the importance of placing machines where foot traffic is inherently high. Meanwhile, in Singapore, the most popular location is the residential areas at 23.6%. The age demographics in Singapore skew older, with 27.8% of participants in the 45-54 bracket, suggesting that easy access to vending machines in these locations caters well to older residents who may prioritize convenience in their daily routines. In Thailand, cash notes are the top choice, with 56.1% of users opting for this traditional method. In India, QR codes lead with 54.6%, reflecting the growing trend towards digital transactions. Meanwhile, Singaporean consumers prefer credit/debit cards at 58.4%, indicating a strong inclination toward cashless convenience. The presence of a higher percentage of older respondents in Singapore—27.8% in the 45-54 age group—may suggest that the second preferred method, coins, resonates with this demographic, as older generations often have a tendency to stick with traditional payment methods. In Malaysia, both credit/debit cards (50%) and QR codes (50.2%) are favored, showcasing a modern preference for digital payment solutions alongside traditional methods.

In Thailand, cash notes are the top choice, with 56.1% of users opting for this traditional method. In India, QR codes lead with 54.6%, reflecting the growing trend towards digital transactions. Meanwhile, Singaporean consumers prefer credit/debit cards at 58.4%, indicating a strong inclination toward cashless convenience. The presence of a higher percentage of older respondents in Singapore—27.8% in the 45-54 age group—may suggest that the second preferred method, coins, resonates with this demographic, as older generations often have a tendency to stick with traditional payment methods. In Malaysia, both credit/debit cards (50%) and QR codes (50.2%) are favored, showcasing a modern preference for digital payment solutions alongside traditional methods.

6. Consumer Concerns: Addressing Barriers to Trust

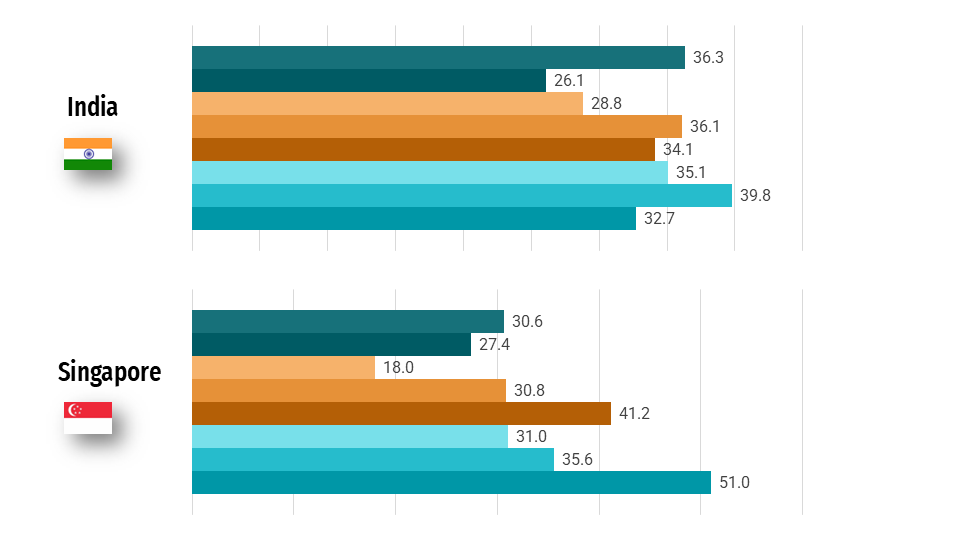

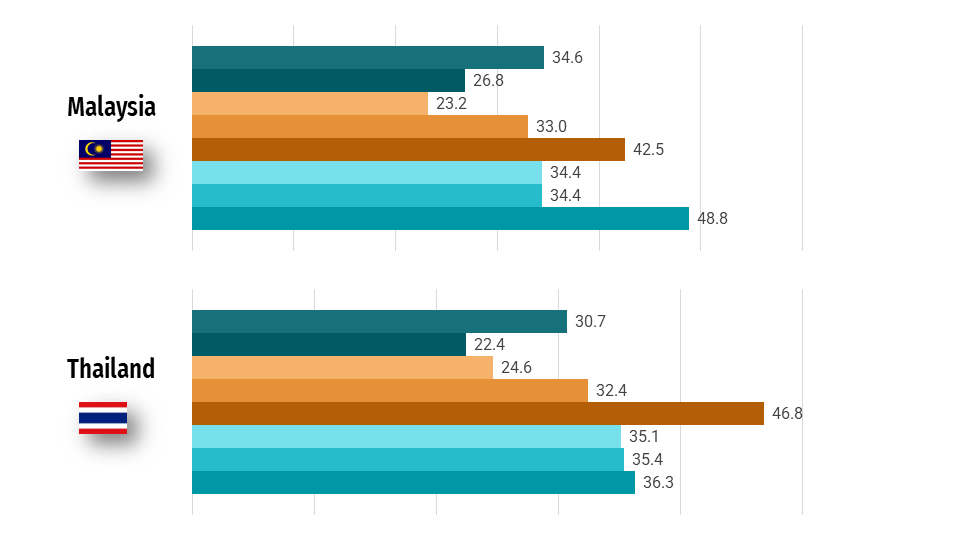

Each country exhibits distinct top concerns regarding vending machines. In India, the primary worry is the reliability of the machine, with 39.8% of users expressing concerns about potential malfunctions. Singaporeans prioritize pricing, with 51.0% highlighting the cost of products as their main issue. In Malaysia, reliability ranks at the forefront as well, with 34.4% worried about machines functioning properly. Meanwhile, in Thailand, the top concern is the expiry date of products, with 46.8% of users expressing trepidation over product freshness. These insights underscore the varying priorities of consumers in each country when using vending machines, with reliability and pricing being recurring themes.

7. Influential Decision Factors: What Drives Choices?

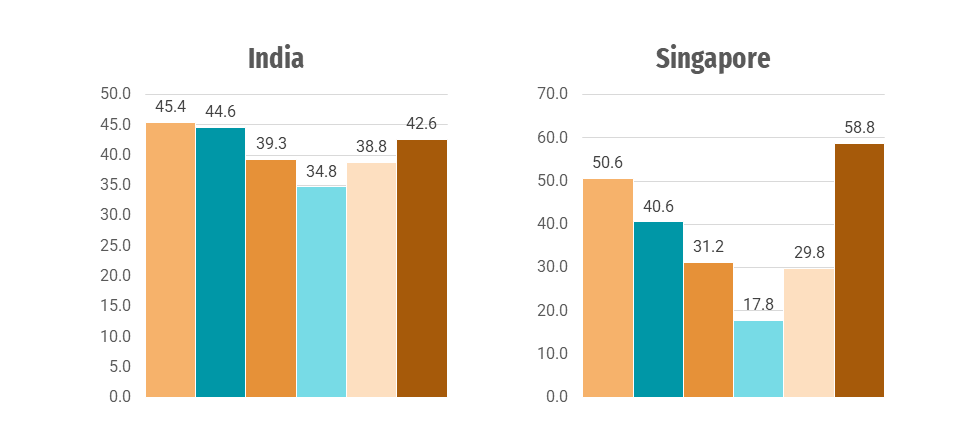

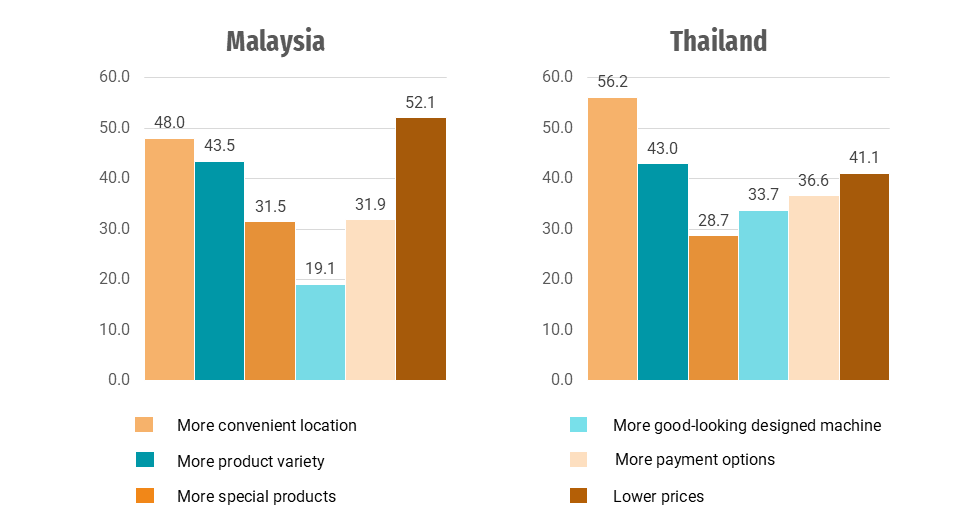

Consumer decisions to use specific vending machines are influenced by multiple factors, with convenience of location being paramount, particularly in Thailand (56.2%), followed by Singapore (50.6%) and Malaysia (48.0%). Product variety is also essential, with 44.6% of Indian respondents and 43.0% of Thai respondents emphasizing the need for diverse options. While machine aesthetics attract interest in India (34.8%) and Thailand (33.7%), the focus is less on design in Singapore (17.8%) and Malaysia (19.1%). Additionally, payment options are relevant, especially in India (38.8%) and Thailand (36.6%), while competitive pricing significantly drives choices in Singapore (58.8%) and Malaysia (52.1%). Overall, understanding these preferences allows vending operators to craft differentiated strategies that enhance user engagement and machine utilization across diverse markets.

Conclusion: Paving the Way for Innovative Solutions

The insights garnered from our investigation into vending machine usage across India, Singapore, Malaysia, and Thailand illustrate diverse consumer needs and preferences that call for tailored approaches. By understanding local demands for convenience, product variety, and reliability, businesses can craft innovative solutions that resonate with consumers. As the vending machine sector continues to evolve, addressing these factors will unlock new opportunities, enabling operators to better cater to regional markets and elevate the consumer experience in this dynamic retail environment. The future of vending machines lies not merely in snacks and beverages but in creating holistic, engaging experiences that align with the fast-paced lifestyles of today’s consumers.